Answered step by step

Verified Expert Solution

Question

1 Approved Answer

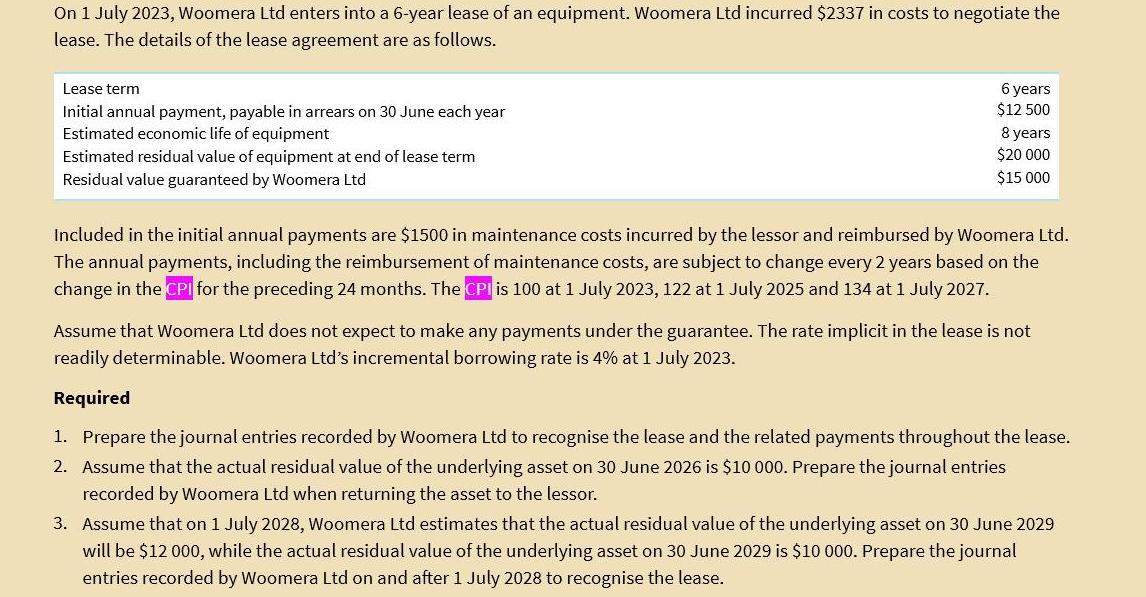

On 1 July 2023, Woomera Ltd enters into a 6-year lease of an equipment. Woomera Ltd incurred $2337 in costs to negotiate the lease.

On 1 July 2023, Woomera Ltd enters into a 6-year lease of an equipment. Woomera Ltd incurred $2337 in costs to negotiate the lease. The details of the lease agreement are as follows. Lease term Initial annual payment, payable in arrears on 30 June each year Estimated economic life of equipment Estimated residual value of equipment at end of lease term Residual value guaranteed by Woomera Ltd 6 years $12 500 8 years $20 000 $15 000 Included in the initial annual payments are $1500 in maintenance costs incurred by the lessor and reimbursed by Woomera Ltd. The annual payments, including the reimbursement of maintenance costs, are subject to change every 2 years based on the change in the CPI for the preceding 24 months. The CPI is 100 at 1 July 2023, 122 at 1 July 2025 and 134 at 1 July 2027. Assume that Woomera Ltd does not expect to make any payments under the guarantee. The rate implicit in the lease is not readily determinable. Woomera Ltd's incremental borrowing rate is 4% at 1 July 2023. Required 1. Prepare the journal entries recorded by Woomera Ltd to recognise the lease and the related payments throughout the lease. 2. Assume that the actual residual value of the underlying asset on 30 June 2026 is $10 000. Prepare the journal entries recorded by Woomera Ltd when returning the asset to the lessor. 3. Assume that on 1 July 2028, Woomera Ltd estimates that the actual residual value of the underlying asset on 30 June 2029 will be $12 000, while the actual residual value of the underlying asset on 30 June 2029 is $10 000. Prepare the journal entries recorded by Woomera Ltd on and after 1 July 2028 to recognise the lease.

Step by Step Solution

★★★★★

3.25 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal entries to recognize the lease and related payments throughout the lease a On 1 July 2023 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started