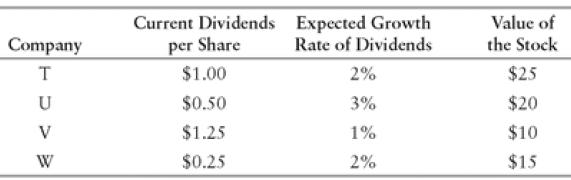

Estimate the expected return for each of the following companies: Company T U V W Current Dividends

Question:

Estimate the expected return for each of the following companies:

Transcribed Image Text:

Company T U V W Current Dividends per Share $1.00 $0.50 $1.25 $0.25 Expected Growth Rate of Dividends 2% 3% 1% 2% Value of the Stock $25 $20 $10 $15

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

To estimate the expected return for each of the companies we need to consider the dividends and the ...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

The Theory And Practice Of Investment Management

ISBN: 9780470929902

2nd Edition

Authors: Frank J Fabozzi, Harry M Markowitz

Question Posted:

Students also viewed these Business questions

-

Balamurugan Petroleum expects three years of exceptionally slow growth as a result of the pandemic. Their dividend of $1.0 (D) will increase by 1% for three years before returning the regular growth...

-

Over the period of time 20092018, the return (per dollar invested) on Maura stock was 0.013469 per month, the return on Ward was 0.013543 per month, and the return on Goldsmith was 0.006504 per...

-

Bill and Fiona Russell have always enjoyed craft beer, and in recent years have started making small batches at home. As they experimented, they mastered several niche recipes including a key lime...

-

YOU have just graduated from Deakin as an accounting and finance graduate. During your time at Deakin, you were organized and diligent with your studies and thus graduated with flying colors. This...

-

Meridian Clothing is a retail store specializing in womens clothing. The store has established a liberal return policy for the holiday season in order to encourage gift purchases. Any item purchased...

-

A company is contracted to build an asset for a customer. The contract price is 5m but the contract stipulates that the company will receive an incentive payment of a further 1m if the asset is...

-

List the outcome(s) of the event It rains all three days.

-

The 7FA gas turbine manufactured by General Electric is reported to have an efficiency of 35.9 percent in the simple-cycle mode and to produce 159 MW of net power. The pressure ratio is 14.7 and the...

-

Fibre Optics Ltd is a high-tech company that produces versatile fibre optics that telecommunication and airline production companies use. Currently, the fibre optic is a very high quality product in...

-

Consider Company RV that has projected earnings per share of $2.5 and a projected book value per share of $20. Determine the estimated value of this Company RV, based on a relative value using the...

-

Estimate the value of a share of stock for each of the following companies using the constant growth model and estimating the average annual growth rate of dividends from 20X1 through 20X6 as given...

-

What market positions do industry rivals occupywho is strongly positioned and who is not?

-

Jennifer purchased stock at $50 per share with a 75% initial margin requirement and a maintenance margin of 35%. How much equity per share must Jennifer contribute when the stock falls to $15 per...

-

Thinking about your present job and your "inventory"of leadership traits and characteristics, where are your strengths and weaknesses as a leader?Is being a leader desirable? If yes, what motivates...

-

You are facing a complex decision with several courses of possible action and probabilities associated with them. The current decision tree, based on the best possible estimates of probabilities and...

-

1. In what ways has Marriot proven an industry leader in the context of entrepreneurship in the hospitality industry. 2. What are the author's metrics of measuring entrepreneurial activity, and do...

-

Suppose you want to model the relationship between the interest rate, the economic growth rate and the inflation rate. what would be first model to fit explain.

-

A college professor won $85,000 in the state lottery; income taxes will take about half the amount. She plans to spend her sabbatical year on leave from the university on an around-the-world trip...

-

The graph of an equation is given. (a) Find the intercepts. (b) Indicate whether the graph is symmetric with respect to the x-axis, the y-axis, or the origin. -3 6 -6 3 x

-

Review the model in Exhibit 5-2 and then reread the Apple case at the beginning of this chapter. List and briefly describe specific points in the case that illustrate the model.

-

Interview a friend or family member about two recent purchase decisions. One decision should be an important purchase, perhaps the choice of an automobile, a place to live, or a college. The second...

-

In your own words, explain how buying behavior of business customers in different countries may have been a factor in speeding the spread of international marketing.

-

If John invested $20,000 in a stock paying annual qualifying dividends equal to 4% of his investment, what would the value of his investment be 5 years from now? Assume Johns marginal ordinary tax...

-

help asap please!

-

Please, help asap! I have one day. Feedback will be given. & show some work. [in Excel] For the final project you will need you to create a spreadsheet /proforma of the cash flows from a property....

Study smarter with the SolutionInn App