The 3-year rate is 2.85%. The 5-year rate is 3.35%. First, interpolate the 4-year interest rate: r4

Question:

The 3-year rate is 2.85%. The 5-year rate is 3.35%. First, interpolate the 4-year interest rate: r4

=

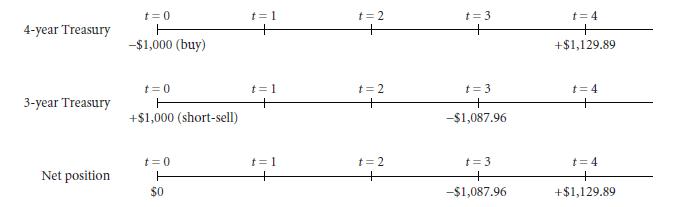

(2.85% + 3.35%)/2 = 3.10%. Buy $1,000 of the 4-year, zero note and short $1,000 of the 3-year, zero note (2.85%/year). Today, you receive and pay $1,000, so the transaction does not cost you anything. In 3-

years, you need to pay the 3-year note—that is, you need to pay $1,000 . 1.02853 ≈ $1,087.96. In 4 years, you receive from the 4-year note $1,000 . 1.0314 ≈ $1,129.89. This is the equivalent of saving at an interest rate r3, 4 of 3.85%. A visual representation follows:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: