The question seems difficult, but it does become easy once you realize the following: If the junior

Question:

The question seems difficult, but it does become easy once you realize the following:

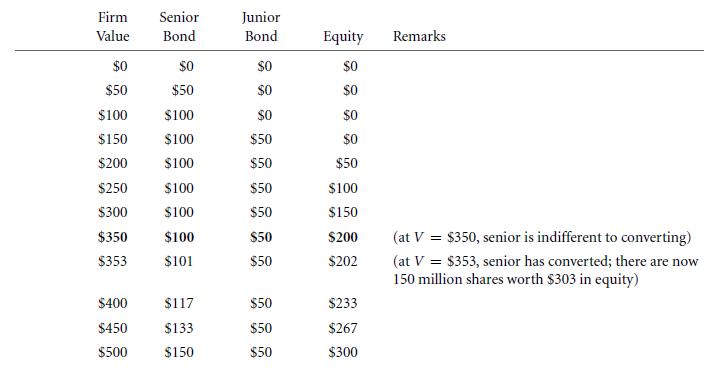

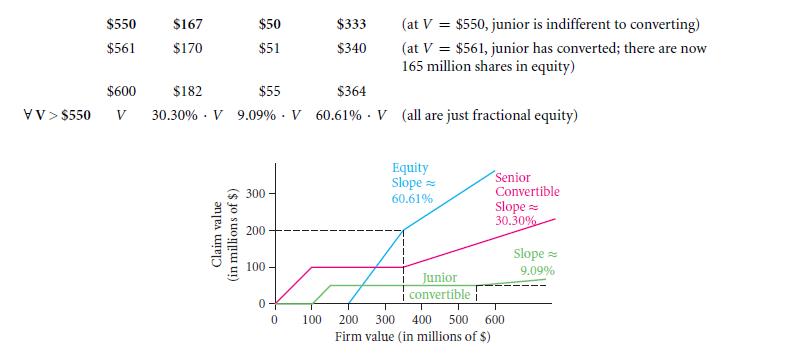

If the junior does not convert, then the senior’s 50 million in new equity shares would represent 50/150 or one-third of the equity (not the company!). Thus, the senior would convert if the value of the equity reaches $300 million. This occurs when the firm value reaches $350 million, because the junior creditors still would have their “$50 million first” claim.

If the senior has converted, then the junior’s 15 million in new equity shares if it converts would represent 15/165 of the firm. This is about 9.1% of the firm value. Therefore, at a firm value of $550 million (solve x . 15/165 = $50), the junior would be indifferent between exercising and not exercising.

These two insights make it easy to write down the payoff table (note my irregular value stepping when it is convenient for explanation), all in millions:

Step by Step Answer: