Bernie Madoff perpetrated the worlds largest Ponzi scheme,1 in which investors were initially estimated to have lost

Question:

Bernie Madoff perpetrated the world’s largest Ponzi scheme,1 in which investors were initially estimated to have lost up to

\($65\) billion. Essentially, investors were promised—and some received—returns of at least 1% per month. However, beginning in the early 1990s, these payments came from funds invested by new investors, not from returns on invested funds. Consequently, when new investor contributions slowed due to the subprime lending crisis in 2008, Madoff ran out of funds to pay redemptions and returns, and the entire scheme unraveled.

As Warren Buffet has said, “You only learn who has been swimming naked when the tide goes out.”2 Bernie Madoff certainly was, much to the chagrin of some supposedly very savvy investors who were attracted by seemingly constant returns of about 1%

per month in up as well as down markets.

Among those who invested sizable sums3 were the actors Kevin Bacon and Kyra Sedgwick as well as Jeffrey Katzenberg, the CEO of DreamWorks Animation.

Others are listed here.

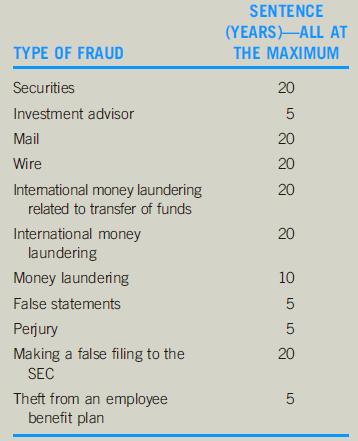

Ultimately, Madoff pleaded guilty to 11 charges by the SEC, confessed, and was sentenced to 150 years in the penitentiary.

The story of how Madoff began his scheme, what he actually did, who suspected he was a fraudster and warned the SEC, why the failed to find wrongdoing, who knew, and who did nothing is a fascinating story of ethical misbehavior, greed, innocence, incompetence, and misunderstanding of duty.

How Did Madoff Do It?

In his plea elocution4 on March 12, 2009, Madoff told the court, The essence of my scheme was that I represented to clients and prospective clients who wished to open investment advisory and investment trading accounts with me that I would invest their money in shares of common stock, options and other securities of large well-known corporations, and upon request, would return to them their profits and principal.…

[F]or many years up until I was arrested … I never invested those funds in the securities, as I had promised.

Instead, those funds were deposited in a bank account at Chase Manhattan Bank. When clients wished to receive the profits they believed they had earned with me or to redeem their principal, I used the money in the Chase Manhattan bank account that belonged to them or other clients to pay the requested funds.5 Of course, in reality, Madoff’s scheme was more complex and went undiscovered for a very long time.

Over the years, Madoff became involved in two major activities as (1) a market maker or broker and (2) an investment adviser or manager. The first, which he began in 1960 as Bernard L. Madoff Securities, matched, by phone, buyers and sellers of stocks of smaller companies that were not traded on large recognized stock exchanges, such as the NYSE. Initially, he made a commission on each overthe-

counter trade, but soon he was buying or selling on his own account, thereby taking the risk of not being able to find a matched buyer or seller and not making a profit on the spread. In time, this form of trading became more regulated, and the spread between the buying and selling prices for shares became restricted to oneeighth of a dollar, or 12.5 cents, per share.

In order to maximize his volume of orders, Madoff would “pay for order flow” a sum of 1 to 2 cents per share of the 12.5\-cent spread to the referring broker. Later, computerized trading6 allowed share prices to be denominated in cents rather than one eighth of a dollar, and the spreads shrunk to 1 cent or so by 2001.7 Consequently, Madoff’s profit on this type of trading activity dwindled, and he had to be creative to make any significant profit. It is speculated8 that he did so by “front running,” a variation on insider trading. Using advance knowledge of a large buy transaction garnered through his “pay for order flow” process, Madoff could buy the stock for his own account at the current price and then sell the stock moments later to fulfill the large buy order at an increased price........

Questions:-

1. Was Madoff’s sentence too long?

2. Some SEC personnel were derelict in their duty.What should happen to them?

3. Are the reforms undertaken by the SEC (see http://www.sec.gov/spotlight/

sec-postmadoffreforms.htm) tough enough and sufficiently encompassing?

4. Does it matter that Madoff’s auditor, Friehling, was his brother-in-law?

5. Does it matter that Friehling did no audit work?

6. Comment on the efficacy of selfregulation in the form of FINRA and in respect to the audit profession.

What are the possible solutions to this?

7. Answer Markopolos’ questions: “How can we go forward without assurance that others will not shirk their civic duty? We can ask ourselves would the result have been different if those others had raised their voices and what does that say about self-regulated markets?”

8. How could Markopolos and the other whistle-blowers have gotten action on their concerns earlier than they did?

9. Did Markopolos act ethically at all times?

10. What were the most surprising aspects of Markopolos’ verbal testimony on YouTube at http://www.youtube.com/

watch?v¼uw_Tgu0txS0?

11. Did those who invested with Madoff have a responsibility to ensure that he was a legitimate and registered investment advisor? If not, what did they base their investment decision on?

12. Should investors who make a lot of money (1% per month while markets are falling) say, “Thank you very much,”

or should they query the unusually large rate of return they are receiving?

13. Should investors who made money from “investing” with Madoff be forced to give up their gains to compensate those who lost monies?

14. Is this simply a case of “buyer beware”?

Step by Step Answer:

Business And Professional Ethics

ISBN: 9781337514460

8th Edition

Authors: Leonard J Brooks, Paul Dunn