Billionaire Raj Rajaratnam was arrested for insider trading on October 15, 2009, and marched in handcuffs from

Question:

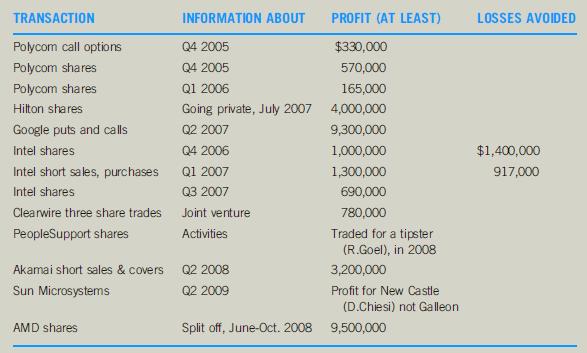

Billionaire Raj Rajaratnam was arrested for insider trading on October 15, 2009, and marched in handcuffs from his New York apartment.1 Up to that point, he had enjoyed fame and fortune for founding the \($7\) billion Galleon Group of hedge funds and its enviable record of securities trading. But instead of being the astute investor everyone thought him to be, it appears that his success was based on using inside information from tipsters, not astute independent analysis of corporate performance. According to the enforcement chief of the Securities Exchange Commission (SEC), Rajaratnam was “not the master of the universe, rather

[he was] a master of the rolodex.”2 He used his contacts to profit from tips on advance information on the performance of IBM, Google, Hilton Hotels, Intel, Polycom, Clearwire, AMD, Akamai, and Sun Microsystems, to name a few.3 The Galleon founder’s inside information network came to light when Mark Lenowitz, a defendant in a 2007 insider trading case, agreed to assist investigators as part of his plea bargain. His assistance led to the prosecution of David Slaine, one of his colleagues at the hedge fund Chelsey Capital. In turn, Slaine fingered Zvi Goffer, a Galleon trader, and the ensuing investigation led to wiretap and other evidence against Rajaratnam and several others at Galleon.4 The inside information network that had brought so much personal success to Rajaratnam

(and others at Galleon) ended up working against them. Further investigations into other network connections are ongoing.........

Questions:-

1. Should inside traders who are nonviolent, white-collar criminals be subject to Mafia-style investigation tools?

2. How can a stock trader know when he or she is receiving inside information that would be illegal to act on?

3. How can a stock trader avoid using insider information?

4. Would a private investor be subject to the same rules against using insider information as a stock trader?

5. Should a person giving a tip (the tipper)

be subject to the same penalties as the user (the tippee)?

Step by Step Answer:

Business And Professional Ethics

ISBN: 9781337514460

8th Edition

Authors: Leonard J Brooks, Paul Dunn