A company has determined that the length of time a receivable is outstanding is the most appropriate

Question:

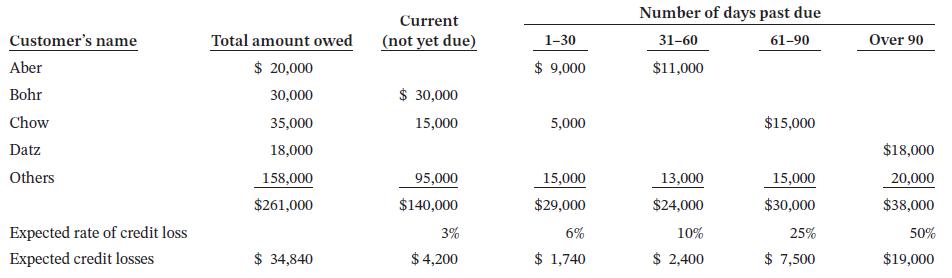

A company has determined that the length of time a receivable is outstanding is the most appropriate credit risk characteristic for determining expected credit losses. The following is an aging schedule for the company’s accounts receivable as at December 31, 2023: On December 31, 2023, the unadjusted balance in the Allowance for Expected Credit Losses (prior to the aging analysis) was a credit of $9,000.

On December 31, 2023, the unadjusted balance in the Allowance for Expected Credit Losses (prior to the aging analysis) was a credit of $9,000.

Required

a. Journalize the adjusting entry to record the expected credit losses on December 31, 2023.

b. Journalize the following selected events and transactions in 2024:

i. On March 1, an $800 customer account that originated in 2024 is judged uncollectible.

ii. On September 1, an $800 cheque is received from the customer whose account was written off as uncollectible on March 1.

c. Journalize the adjusting entry for credit losses on December 31, 2024, assuming that the unadjusted balance in Allowance for Expected Credit Losses at that time is a debit of $1,000 and an aging schedule prepared at that date indicates that the expected total credit losses will be $33,500.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley