Barnes & Noble, Inc., revolutionized bookselling by making its stores public spaces and community institutions where customers

Question:

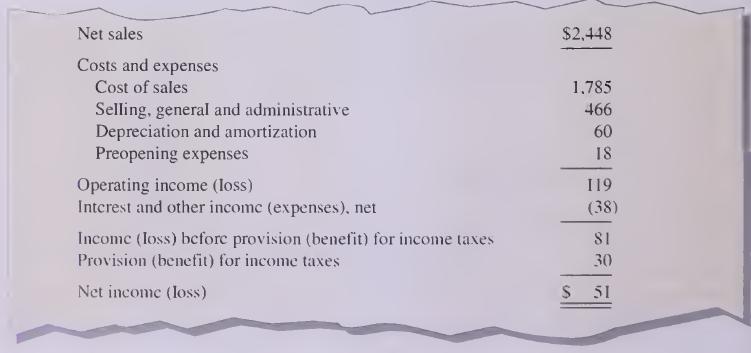

Barnes & Noble, Inc., revolutionized bookselling by making its stores public spaces and community institutions where customers may browse, find a book, relax over a cup of coffee, talk with authors, and join discussion groups. Today it is fighting increasing competition not only from traditional sources but also from on-line booksellers. Presented here is a recent income statement (in millions).

Its beginning and ending stockholders" equity was $400 and $446, respectively.

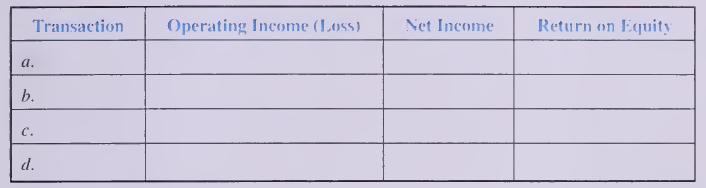

Required: 1. Listed here are hypothetical additional transactions. Assuming that they had also occurred during the fiscal year, complete the following tabulation, indicating the sign of the effect of each additional transaction ( + for increase, - for decrease, and NE for no effect). Consider each item independently and ignore taxes.

a. Recorded and received additional interest income of $4.

b. Purchased $25 of additional inventory on open account.

c. Recorded and paid additional advertising expense of $9.

d. Additional shares of common stock are issued for $50 cash. 2. Assume that next period. Barnes & Noble does not pay any dividends, does not issue or retire stock, and earns 20 percent more than during the current period. Will Barnes & Noble's ROE next period be higher, lower, or the same as in the current period? Why?

2. Assume that next period. Barnes & Noble does not pay any dividends, does not issue or retire stock, and earns 20 percent more than during the current period. Will Barnes & Noble's ROE next period be higher, lower, or the same as in the current period? Why?

Step by Step Answer: