Cathys Cuisine Ltd. is a small restaurant and catering business started three years ago by Cathy Crosby.

Question:

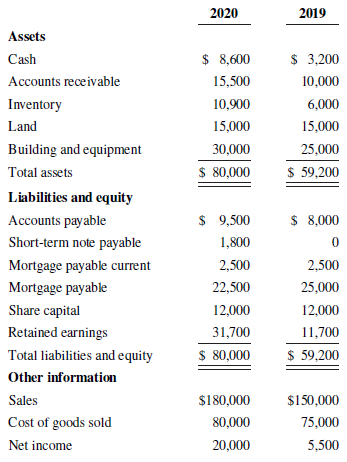

Cathy’s Cuisine Ltd. is a small restaurant and catering business started three years ago by Cathy Crosby. Initially the company’s operations consisted of a small diner. In 2019, the company added the catering services as a way to expand sales without having to add space for seats. As the catering side of the business grew in 2020, the company purchased a used vehicle for deliveries. All sales in the diner are cash, debit, or credit card, but for catering jobs, customers are invoiced after the event. Most of the company’s suppliers off er terms of 30 days. Selected financial information for Cathy’s Cuisine Ltd. follows.

Required

a. Assume the growth in sales in 2020 is primarily from the catering business. Calculate the gross margins and the profit margins and comment on whether you think the company should be focusing on the catering business or the diner.

b. Calculate the company’s current ratio and quick ratio for both years and comment on the company’s liquidity. Do you think the company is more liquid or less in 2020? What items on the statement of financial position support your position?

c. Calculate the company’s accounts receivable turnover ratio for 2020. How quickly is the company collecting its receivables? Do you think it is doing a good job of managing its receivables?

d. Assume that 50% of the sales come from the catering business and recalculate the accounts receivable turnover for 2020. How does that affect your assessment of how receivables are being managed?

e. Calculate the company’s inventory turnover ratio for 2020.

f. Calculate the company’s accounts payable turnover ratio for 2020. Are suppliers being paid on time?

g. Using your analysis of the company’s receivables and payables, what would you recommend be done to improve the management of those accounts?

h. Prepare a brief memo to Cathy outlining why it may be useful to break out the company’s financial results by segment (diner and catering).

Inventory Turnover RatioInventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley