You are considering investing in the retail sector and have identified two companies for further analysis. Financial

Question:

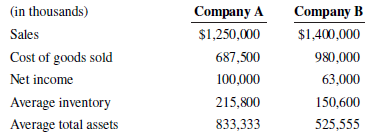

You are considering investing in the retail sector and have identified two companies for further analysis. Financial information for the two companies is as follows:

Required

a. Calculate and compare the following ratios for the two companies:

i. Return on assets

ii. Gross margin

iii. Profit margin

iv. Inventory turnover

v. Days to sell inventory

b. Which company is likely following a low-cost producer strategy? Support your conclusion with reference to the ratios in part “a.” What strategy might the other company be following?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley

Question Posted: