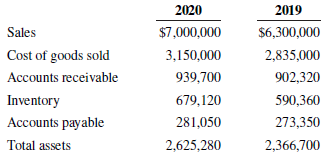

The following financial information is for Atomister Industries Inc.: Atomister is a distributor of new and used

Question:

The following financial information is for Atomister Industries Inc.:

Atomister is a distributor of new and used machinery parts operating in Saskatchewan. It offers 30-day terms and all sales are on credit. The company has a large inventory due to the number of parts it stocks for different types of customers and projects. Most of its suppliers offer terms of 30 days, and Atomister tries to stay on good terms with its suppliers by paying on time.

Required

a. What is the average time it takes Atomister to collect its accounts receivable? How does that compare with the credit terms that the company offers?

b. What is the average length of time that it takes Atomister to sell through its inventory?

c. What is the average length of time that it takes Atomister to pay its payables? How does that compare with the credit terms it is offered?

d. The cash-to-cash cycle is the length of time from when a company purchases an item of inventory to when it collects cash from its sale, reduced by the days it takes to pay the related accounts payable. How long is Atomister’s cash-to-cash cycle?

e. Assume that Atomister finances its inventory with a working capital loan from the bank. If Atomister could improve its collection of receivables and reduce the days to collect receivables to an average of 40 days, how would this affect the company’s cash-to-cash cycle and its working capital loan? What advantages would this provide to the company?

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley