(Comparing the percentage-of-receivables and percentage-of-credit-sales methods, LO 3) The following information has been obtained about Elzevir Inc....

Question:

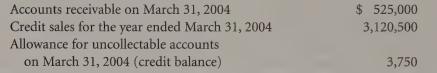

(Comparing the percentage-of-receivables and percentage-of-credit-sales methods, LO 3) The following information has been obtained about Elzevir Inc. (Elzevir)

for 2004. The information was obtained before any year-end adjusting entries were made. Elzevir’s year end is March 31:

Required:

a. Calculate the bad debt expense that Elzevir would record for the 2004 fiscal year, assuming that management expects that 6% of year-end accounts receivable will not be collected. What would be the balance in Allowance for Uncollectable Accounts on March 31, 2004? Prepare the journal entry to record the bad debt expense.

b. Calculate the bad debt expense that Elzevir would record for the 2004 fiscal year, assuming that management expects that 1.5% of credit sales during fiscal 2004 will not be collected. What would be the balance in Allowance for uncollectable accounts on March 31, 2004? Prepare the journal entry to record the bad debt expense.

c. What would your answers in

(a) and

(b) be if the balance in Allowance for Uncollectable Accounts on March 31, 2004 (before any year-end adjusting entries) was a debit of $3,750? Explain any differences you find.

Step by Step Answer: