(Considering comparability, LO 3) Donjek Ltd. (Donjek) and Quigley Inc. (Quigley) are two companies in the same...

Question:

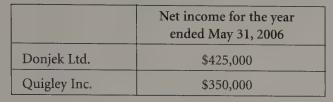

(Considering comparability, LO 3) Donjek Ltd. (Donjek) and Quigley Inc. (Quigley) are two companies in the same industry. The net incomes for the compa- nies for the year ended May 31, 2006 are shown below:

Upon reviewing the financial statements you discover that the two companies use identical accounting policies except for inventory and amortization of capital assets.

Donjek uses a method for accounting inventory called FIFO, while Quigley uses a method called average cost (these methods of accounting for inventory will be discussed in Chapter 8). Also, Donjek uses a method called straight-line amortization for amortizing its capital assets while Quigley uses a method called accelerated amortization (these methods of accounting for amortization will be discussed in Chapter 9).

Had Donjek used average cost for accounting for inventory, its net income would have been $50,000 lower than it reported in its financial statements. Had Quigley used FIFO instead of average cost for accounting for inventory, its net income would have been $50,000 higher than it reported in its financial statements. Had Donjek used accelerated amortization instead of straight-line amortization, its net income would have been $25,000 lower than it reported in its financial statements. Had Quigley used straight-line amortization instead of accelerated amortization, its net income would have been $25,000 higher than it reported in its financial statements.

Quigley Inc.

Required:

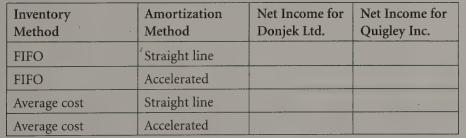

a. Compute net income for Donjek and Quigley under the following circumstances:

b. Which company performed better during the year ended May 31, 2006? Explain.

c. Why do you think the managers of Donjek and Quigley selected the accounting policies they did? Explain.

d. What are the implications of having more than one acceptable accounting method under GAAP on a user’s ability to use the financial statements?

Step by Step Answer: