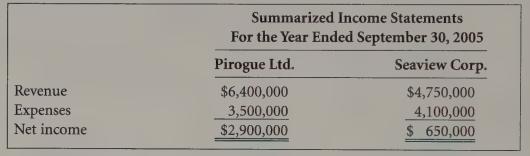

(Consolidated income statement, LO 1) The summarized income statements for Pirogue Ltd. (Pirogue) and Seaview (Seaview) Corp....

Question:

(Consolidated income statement, LO 1) The summarized income statements for Pirogue Ltd. (Pirogue) and Seaview (Seaview) Corp. for the fiscal year ended April 30, 2005 are shown below:

The following information is provided:

Required:

During fiscal 2005, Seaview sold, on credit, merchandise to Pirogue for $500,000. Seaview paid $275,000 for the merchandise. At the end of fiscal 2005, Pirogue had sold none of the merchandise.

On the date it was purchased by Pirogue, Seaview reported capital assets of $3,100,000 on its balance sheet. This amount is being amortized on a straightline basis over ten years from the date of the purchase. These assets had fair values of $4,100,000 on the date Seaview was purchased. The fair value adjustment is also being amortized on a straight-line basis over ten years.

. At the end of fiscal 2005 management determined that the goodwill that was recorded when Pirogue purchased Seaview was impaired and had to be written down by $250,000.

During fiscal 2005 Seaview sold all of the inventory that was on hand when it was purchased on April 30, 2004. The difference between the cost of the inven- tory to Seaview and its fair value on April 30, 2004 was $175,000 (which was the full difference between the fair value and book value of Seaview’s current assets on April 30, 2004).

Prepare the summarized consolidated income statement for fiscal 2005. Explain why Seaview’s net income has to be adjusted when preparing the con- solidated income statement.

Step by Step Answer: