The Royal Bank of Canada (RBC) is the largest bank in Canada and employs about 79,000 full-time

Question:

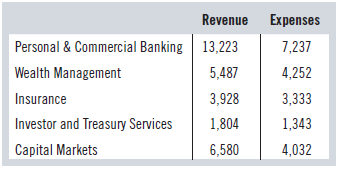

The Royal Bank of Canada (RBC) is the largest bank in Canada and employs about 79,000 full-time and part-time employees who serve 15 million customers in Canada, the United States, and 44 other countries. The performance of the five major segments of the bank in 2013 is summarized in the following table, derived from the RBC’s 2013 annual report:

Suppose that, on reading RBC’s annual report for 2013, you wish to project future revenues and expenses for the five segments listed in the table. You project that they’ll remain constant, but, in view of uncertain economic conditions, you give upper and lower limits on your projection of plus or minus 12% for Personal & Commercial Banking, Wealth Management, and Insurance, and plus or minus 18% for Investor and Treasury Services and Capital Markets. The upper and lower limits on your projections represent the range within which you are 95% confident your projection will lie. Assuming that your projections are Normally distributed, and that all the revenues and expenses for each segment are uncorrelated, calculate dollar values for your projections for total revenue and total expenses over all five segments. Express your projections of the total revenue and expenses in terms of a 95% confidence range, as above—that is, Projected total revenue = $x plus or minus y%. Now do the same thing for net income = revenue – expenses for the total of the five segments. Explain why your percentages y% vary with what it is you’re projecting. Which of your percentages y% is larger than the others? Why? What difference does it make if you assume that revenues for Canadian banking and insurance have a correlation of 0.38, and why?

Step by Step Answer:

Business Statistics

ISBN: 9780133899122

3rd Canadian Edition

Authors: Norean D. Sharpe, Richard D. De Veaux, Paul F. Velleman, David Wright