(Determining missing information, LO 3) Calculate the missing information (indicated by shaded areas) from the following cash...

Question:

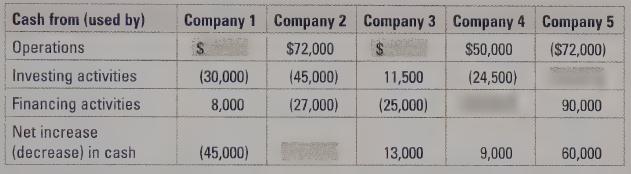

(Determining missing information, LO 3) Calculate the missing information

(indicated by shaded areas) from the following cash flow statements:

Transcribed Image Text:

Cash from (used by) Operations Company 1 Company 2 Company 3 Company 4 Company 5 $72,000 $50,000 ($72,000) Investing activities (30,000) (45,000) 11,500 (24,500) Financing activities 8,000 (27,000) (25,000) 90,000 Net increase (decrease) in cash (45,000) 13,000 9,000 60,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

i need help from section 3 part A I have already posted this and you asked me to post under advanced option Assignment Tier 1 Financial Planning (Tier1FPPA_AS_v1A3) Page 2 of 92 Student...

-

Im having trouble with question 3 part A of the attached file. I know and understand her needs but im not sure if im filling out the table correctly ? Assignment Tier 1 Financial Planning...

-

A random sample of size 36 is taken from a population with mean u 18 and standard deviation a 6. What are the expected value and the standard deviation for the sampling distribution of the sample...

-

Please research a small business Chagrin Falls Popcorn Shop ( https://www.chagrinfallspopcorn.com/ ) social media, and mobile marketing they have been using, etc). In the final exam, you will put...

-

Select the most beneficial of these alternatives.

-

Product Costing Review Mad Dog Enterprises manufactures computer game control devices such as joysticks and steering wheels. Following is a list of the costs incurred by Mad Dog in 2009: Compute the...

-

Have they begun to think about these in the organisations you have studied? Collect new examples of one operational and one management information system, from someone working in an organisation.

-

Compute the amount that can be borrowed under each of the following circumstances: 1. A promise to repay $90,000 seven years from now at an interest rate of 6%. 2. An agreement made on February 1,...

-

Make-or-Buy Decision Matchless Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $57 per unit. The company, which is currently operating below full...

-

(Calculating cash from operations, LO 3) You are provided the following information about Joggins Inc. (Joggins) for 2015: Required: Calculate cash from operations for Joggins for 2015. Provide a...

-

(Classifying transactions for a cash flow statement, LO 3) Basanti Oil Inc. (Basanti) is a privately owned oil exploration and production company. For each of the following specify whether the item...

-

For the following exercises, perform the indicated operation and express the result as a simplified complex number. (6 2i)(5)

-

Machine cost = $15,000; life = 8 years; salvage value = $3,000. What minimum cash return would an investor demand annually from the operation of this machine if he desires interest annually at the...

-

Write a program that prompts for the student's name, the number of exams, the exam score of each exam, and display the letter grade for the student. Read the entire problem description before coding....

-

Considering only the vertical stabilizer and rudder, explain the aerodynamic forces and moments that are created. You must include at least applicable airfoil terminology, description of force...

-

part. Review A bicycle wheel is rotating at 47 rpm when the cyclist begins to pedal harder, giving the wheel a constant angular acceleration of 0.44 rad/s. Part B How many revolutions does the wheel...

-

Suppose the number of students who register for a certain class each semester can be modeled by a Poisson distribution with average 10. Suppose further that each student passes the class with...

-

State the conditions under which the market interest rate is (a) Higher than (b) Lower than (c) The same as the real interest rate.

-

Research corporate acquisitions using Web resources and then answer the following questions: Why do firms purchase other corporations? Do firms pay too much for the acquired corporation? Why do so...

-

Be prepared to explain the texts comprehensive To illustrate the issues related to interest capitalization, assume that on November 1, 2016, Shalla Company contracted Pfeifer Construction Co. to...

-

On April 1, 2020. Indigo Company received a condemnation award of $473,000 cash as compensation for the forced sale of the company's land and building, which stood in the path of a new state highway....

-

The market price of a stock is $24.55 and it is expected to pay a dividend of $1.44 next year. The required rate of return is 11.23%. What is the expected growth rate of the dividend? Submit Answer...

Study smarter with the SolutionInn App