During fiscal 2014, Husavick Inc. (Husavick) borrowed $250,000 from a private lender. The loan agreement requires that

Question:

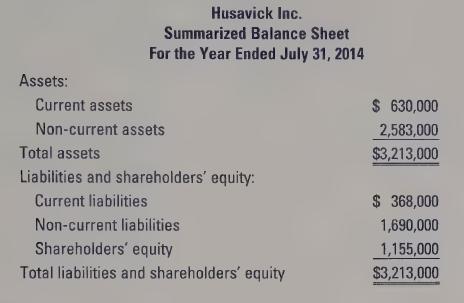

During fiscal 2014, Husavick Inc. (Husavick) borrowed $250,000 from a private lender. The loan agreement requires that Husavick’s debt-to-equity ratio not exceed 1.8:1 at any time.

The loan is repayable in 2020. You have been provided with the following information from Husavick’s accounting records:

Required:

a. Calculate Husavick’s debt-to-equity ratio on July 31, 2014.

b. How much additional debt could Husavick carry without violating the debt covenant on July 31, 2014?

c. How much could Husavick have paid in dividends during fiscal 2014 without violating the debt covenant?

d. What would be the effect on Husavick’s debt-to-equity ratio if it declared a $150,000 dividend on July 31, 2014 that was to be paid on August 15, 2014? What could be done to solve the problem that is created by the dividend declaration?

Step by Step Answer: