Examine Note 28 to Brookfields financial statements and answer the following questions on segment disclosure: a. Identify

Question:

Examine Note 28 to Brookfield’s financial statements and answer the following questions on segment disclosure:

a. Identify the business segments in which Brookfield operates. Which segment has the most revenues? Which has the most assets? Which has the most income?

b. Identify the geographic segments that Brookfield reports in Note 28. Which segment has the most revenues? Which has the most assets? Why do you think segment income information isn’t provided for the geographic segments?

c. Is the segmented information provided only for the entities that are consolidated into Brookfield’s consolidated financial statements? Explain.

d. Why is segment disclosure required under IFRS? As a user of Brookfield’s annual report, how would your ability to use the financial statements be impaired by not having the segmented information?

e. What are the limitations of Brookfield’s segment disclosure?

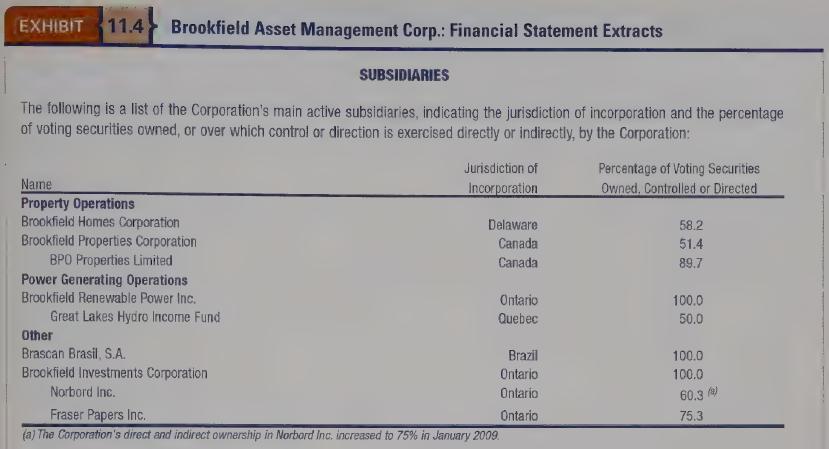

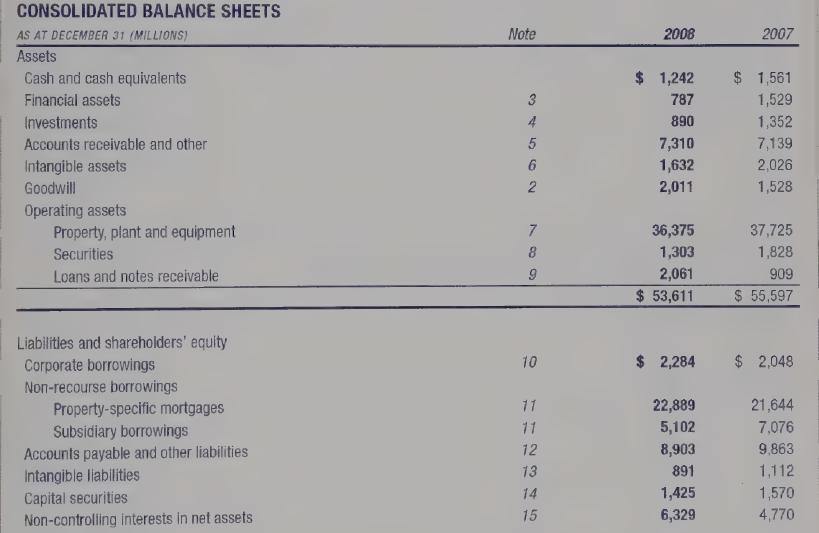

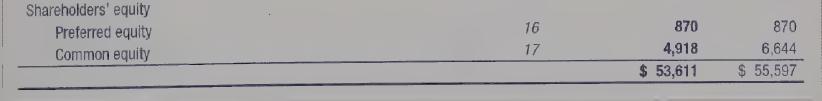

Brookfield Asset Management Inc. (Brookfield) is a global asset management company focused on property, power, and other infrastructure assets. The company has approximately $80 billion under management. Brookfield owns and manages one of the largest portfolios of premier office properties and hydroelectric power generation facilities as well as transmission and timberland operations, located in North and South America and Europe. The company is listed on the New York and Toronto stock exchanges. Brookfield's consolidated balance sheets, statements of income and comprehensive income, and extracts from the statements of cash flows, notes to the financial statements, and annual information form are provided in Exhibit 11.4.

Step by Step Answer: