The following questions pertain to Brookfields non-controlling interest: a. What amount of non-controlling interest is reported on

Question:

The following questions pertain to Brookfield’s non-controlling interest:

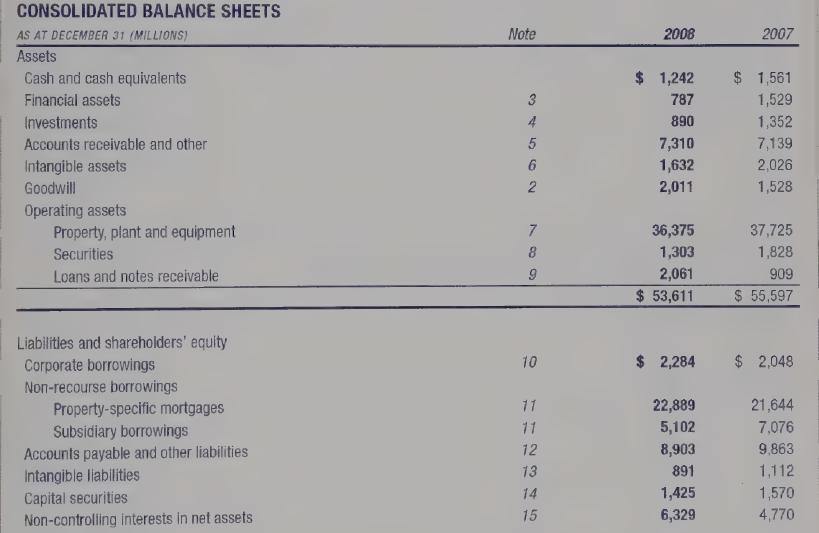

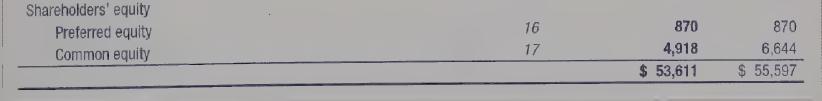

a. What amount of non-controlling interest is reported on Brookfield’s December 31, 2008 balance sheet? What does this amount represent?

b. What amount of non-controlling interest is reported on Brookfield’s statement of income for the year ended December 31, 2008? What does this amount represent?

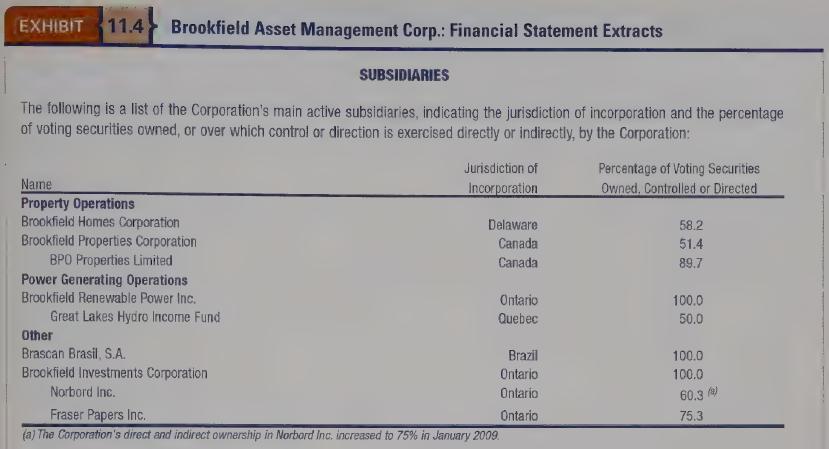

c. Which companies in Brookfield’s portfolio gave rise to the non-controlling interest?

d. Why is the non-controlling interest added back to income from continuing operations when calculating cash from operations?

e. How much of the non-controlling interest was distributed as dividends?

f. If you were an investor in Brookfield Properties Corporation, a company 51.4 percent owned by Brookfield, how would you use the non-controlling interest information included in Brookfield’s financial statements?

Brookfield Asset Management Inc. (Brookfield) is a global asset management company focused on property, power, and other infrastructure assets. The company has approximately $80 billion under management. Brookfield owns and manages one of the largest portfolios of premier office properties and hydroelectric power generation facilities as well as transmission and timberland operations, located in North and South America and Europe. The company is listed on the New York and Toronto stock exchanges. Brookfield's consolidated balance sheets, statements of income and comprehensive income, and extracts from the statements of cash flows, notes to the financial statements, and annual information form are provided in Exhibit 11.4.

Step by Step Answer: