Exhibits 10.11A and 10.11B contain excerpts from the University of Torontos annual report for its 2015/16 fiscal

Question:

Exhibits 10.11A and 10.11B contain excerpts from the University of Toronto’s annual report for its 2015/16 fiscal year.

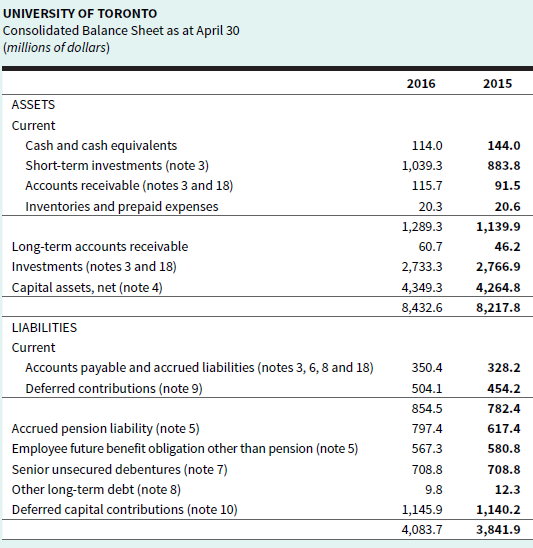

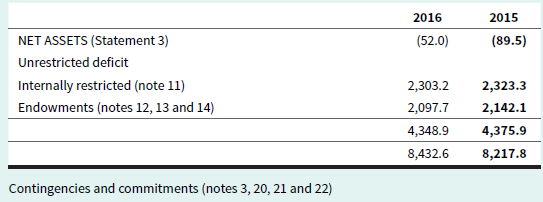

EXHIBIT 10.11A University of Toronto’s 2015/16 Consolidated Balance Sheets

Excerpt from University of Toronto’s 2015/16 Annual Report

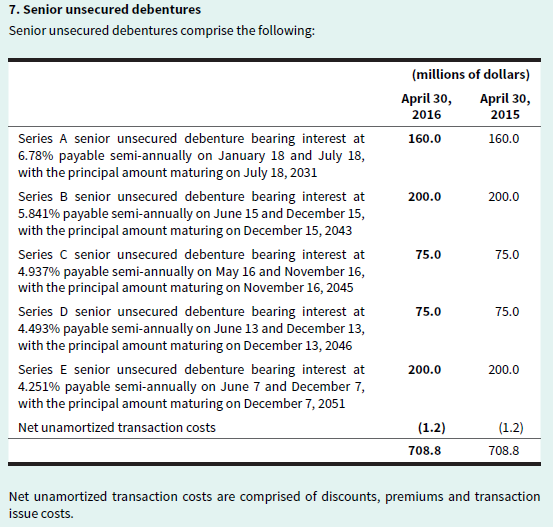

8. Other long-term debt

Other long-term debt consists of mortgages of $3.4 million (2015 – $4.1 million) maturing in 2019 and 2020 against which the related properties are pledged as security (note 4), term loans of $4.2 million (2015 – $5.2 million) maturing from 2017 to 2020 and the fair value of interest rate swap contracts of $4.0 million (2015 – $4.7 million) (note 3). The current portion of other long-term debt of $1.8 million (2015 – $1.8 million) is included in accounts payable and accrued liabilities. The weighted average effective interest rate of the mortgages and term loans, aft er giving effect to the interest rate swap contracts, was 5.7% (2015 – 5.7%) and 6.6% (2015 – 6.5%), respectively. Anticipated requirements to meet the principal portion of the other long-term debt repayments over the next five fiscal years are as follows:

2017 – $1.8 million, 2018 – $1.9 million, 2019 – $1.9 million, 2020 – $1.4 million, and 2021 – $0.6 million.

Required

a. Refer to Note 7 in Exhibit 10.11B. Explain what it means when it states that the debentures are “senior unsecured debentures.”

b. At what amount are these debentures carried on the University of Toronto’s balance sheet (statement of financial position) in Exhibit 10.11A? Explain the amount these debentures will be carried at just prior to their various maturity dates.

c. Were the debentures sold at a premium or discount? How can you tell? Will the interest costs of the university be more, less, or equal to the contract rate of the debentures?

d. Refer to Note 8 in Exhibit 10.11B. The university also had an outstanding mortgage at April 30, 2016. Was this mortgage secured? Did it require blended repayments?

MaturityMaturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley