Question:

ZoomerMedia Limited is a multimedia company that serves the 45-plus “zoomer” demographic through television, radio, magazine, Internet, conferences, and tradeshows. Exhibits 10.15A and 10.15B contain excerpts from ZoomerMedia’s 2016 annual report.

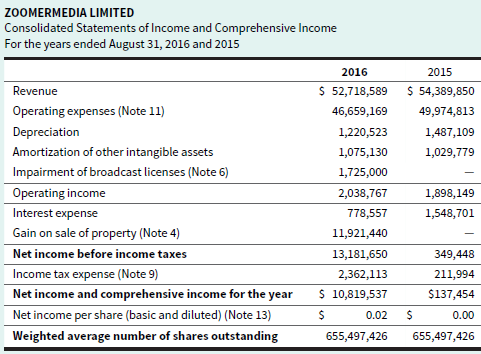

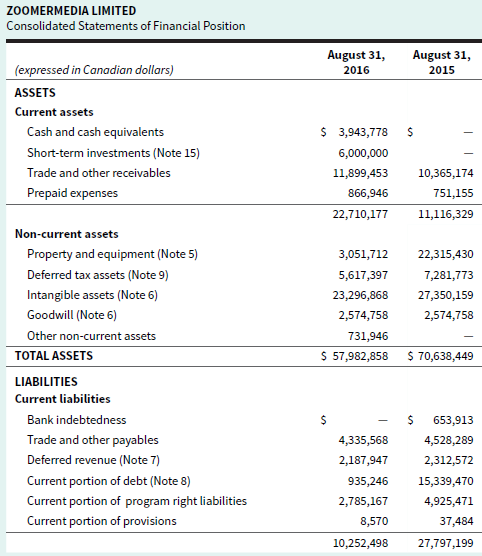

EXHIBIT 10.15A ZoomerMedia Limited’s 2016 Consolidated Statements of Income and Comprehensive Income

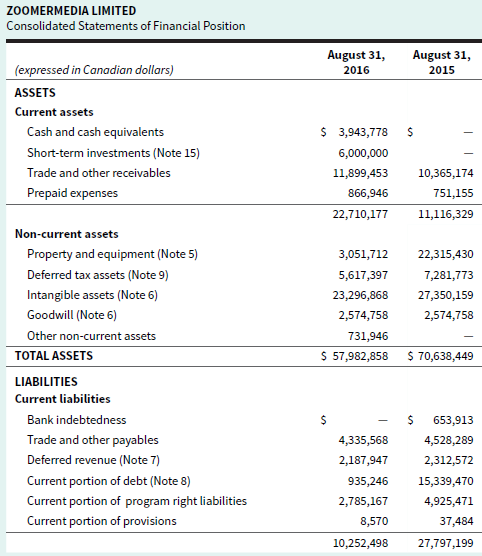

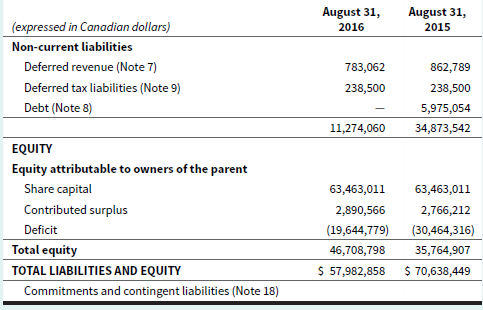

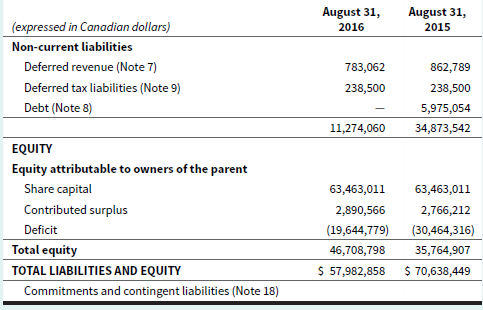

EXHIBIT 10.15B ZoomerMedia Limited’s 2016 Consolidated Statements of Financial Position

Required

a. Calculate the debt to equity ratio, the net debt as a percentage of total capitalization ratio, and the interest coverage ratio for the years ending August 31, 2016, and 2015. Note: Impairment charges should be treated like amortization when determining EBITDA.

b. Identify the major factors that caused the changes in these ratios.

c. Write a short report commenting on the results of the ratio calculations in part “a.” Be sure to comment from the perspectives of an existing shareholder and a potential lender of long-term debt.

Transcribed Image Text:

ZOOMERMEDIA LIMITED Consolidated Statements of Income and Comprehensive Income For the years ended August 31, 2016 and 2015 2016 2015 $ 52,718,589 $ 54,389,850 Revenue Operating expenses (Note 11) 46,659,169 49,974,813 Depreciation 1,487,109 1,220,523 Amortization of other intangible assets 1,075,130 1,029,779 Impairment of broadcast licenses (Note 6) 1,725,000 Operating income 1,898,149 2,038,767 Interest expense 1,548,701 778,557 Gain on sale of property (Note 4) 11,921,440 Net income before income taxes 13,181,650 349,448 Income tax expense (Note 9) 211,994 2,362,113 S 10,819,537 Net income and comprehensive income for the year $137,454 Net income per share (basic and diluted) (Note 13) 0.02 0.00 Weighted average number of shares outstanding 655,497,426 655,497,426 ZOOMERMEDIA LIMITED Consolidated Statements of Financial Position August 31, August 31, (expressed in Canadian dollars) 2016 2015 ASSETS Current assets Cash and cash equivalents $ 3,943,778 Short-term investments (Note 15) 6,000,000 Trade and other receivables 11,899,453 10,365,174 Prepaid expenses 866,946 751,155 22,710,177 11,116,329 Non-current assets Property and equipment (Note 5) 3,051,712 22,315,430 Deferred tax assets (Note 9) 5,617,397 7,281,773 Intangible assets (Note 6) 23,296,868 27,350,159 Goodwill (Note 6) 2,574,758 2,574,758 Other non-current assets 731,946 TOTAL ASSETS $ 57,982,858 $ 70,638,449 LIABILITIES Current liabilities Bank indebtedness %24 %24 653,913 Trade and other payables 4,335,568 4,528,289 Deferred revenue (Note 7) 2,187,947 2,312,572 Current portion of debt (Note 8) 935,246 15,339,470 Current portion of program right liabilities 2,785,167 4,925,471 Current portion of provisions 8,570 37,484 10,252,498 27,797,199