Exhibits 10.14A to 10.14C contain extracts from Rogers Sugar Inc.s 2016 annual report. EXHIBIT 10.14A Rogers Sugar

Question:

Exhibits 10.14A to 10.14C contain extracts from Rogers Sugar Inc.’s 2016 annual report.

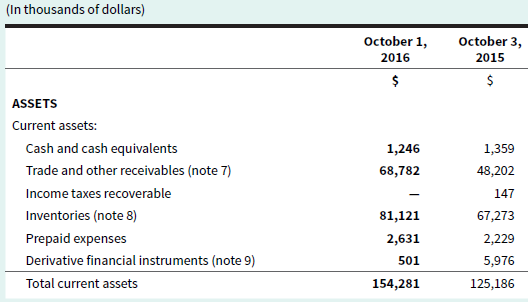

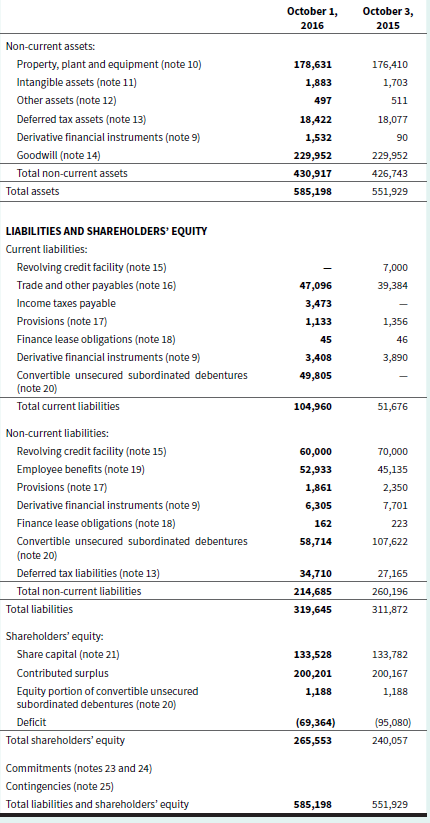

EXHIBIT 10.14A Rogers Sugar Inc.’s 2016 Consolidated Statements of Financial Position

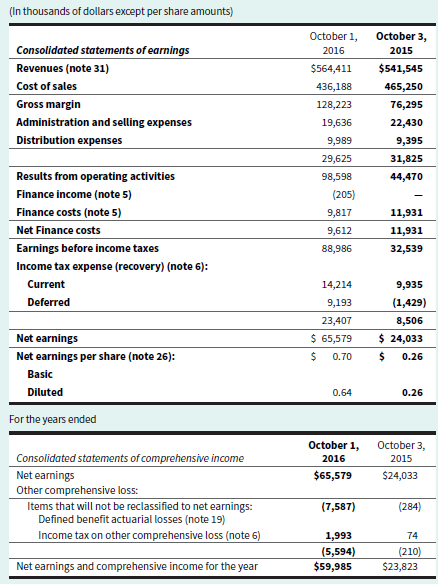

EXHIBIT 10.14B Rogers Sugar Inc.’s 2016 Consolidated Statements of Earnings and Comprehensive Income

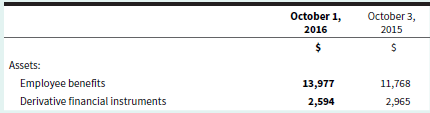

EXHIBIT 10.14C Excerpt from Rogers Sugar Inc.’s 2016 Annual Report

Notes to consolidated financial statements

(In thousands of dollars except as noted and per share amounts)

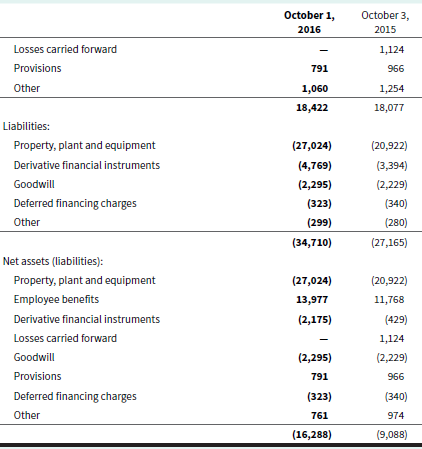

13. Deferred tax assets and liabilities:

The deferred tax assets (liabilities) comprise the following temporary differences:

Required

a. For the year ended October 1, 2016, determine Rogers’ total income tax expense. Also, determine how much of this was for current tax and how much was related to deferred taxes.

b. Rogers reported income taxes recoverable and income taxes payable on its statement of financial position. Quantify those amounts and explain how it would be possible to have a recoverable amount and a payable amount at the same time.

c. Rogers also reported deferred tax assets and deferred tax liabilities on its statement of financial position. Of the $34,710 in deferred tax liabilities, $27,024 related to property, plant, and equipment. Given that significant deferred tax liabilities exist, what do we know about how the company’s depreciation expense related to its property, plant, and equipment compares with the capital cost allowance being claimed on these assets for tax purposes?

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley