Vancouver-based Aritzia Inc. designs apparel and accessories, which it sells in retail locations and online, including 61

Question:

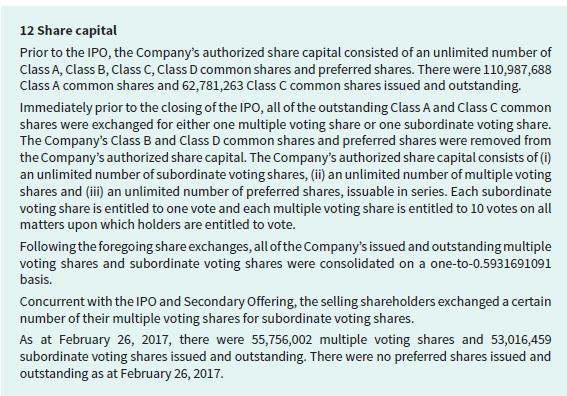

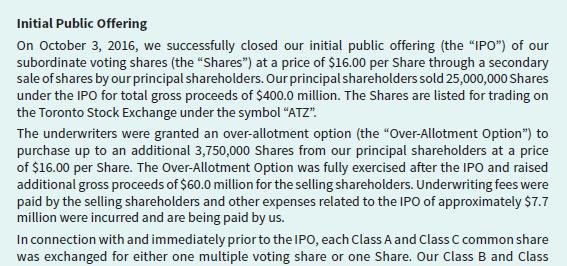

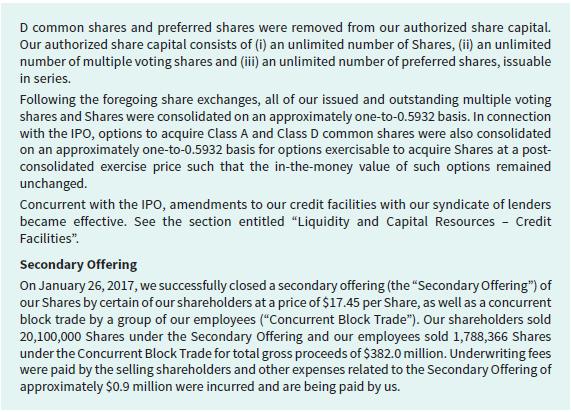

Vancouver-based Aritzia Inc. designs apparel and accessories, which it sells in retail locations and online, including 61 stores in Canada and 20 in the United States. The share capital note from the company’s financial statements for the year ended February 26, 2017, is presented in Exhibit 11.15A. Exhibit 11.15B includes an extract from Aritzia’s 2017 annual information form that outlines the multiple-voting share structure.

Required

a. Describe the changes that the company made to its capital structure when it went public.

b. How much money did Aritzia raise through its IPO? On a percentage basis, how much were the total fees and expenses incurred as part of the IPO relative to the funds raised though the IPO?

c. States that prior to the IPO, the company consolidated its outstanding shares. Explain what this means and what effect this step would have on share value.

d. At the close of the market on June 30, 2021, Aritzia’s common shares were trading at $37.08 per share. If you had purchased 100 shares during the company’s IPO, calculate the amount by which your investment would have appreciated. Note that Aritzia has not paid any dividends since its IPO.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley