Exhibits 5.19A and 5.19B contain the consolidated statements of cash flows and related note disclosure for The

Question:

Exhibits 5.19A and 5.19B contain the consolidated statements of cash flows and related note disclosure for The Second Cup Ltd.

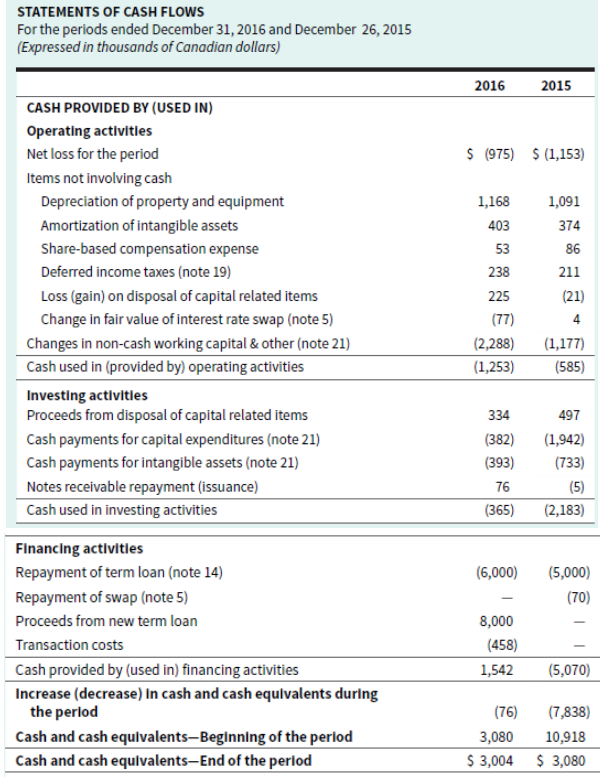

EXHIBIT 5.19A The Second Cup Ltd.’s 2016 Statements of Cash Flows

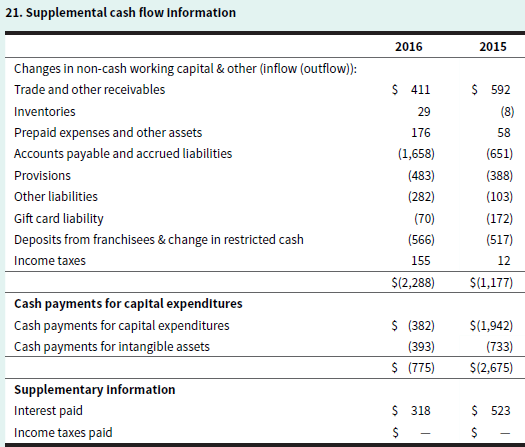

EXHIBIT 5.19B Excerpt from the Second Cup Ltd.’s 2016 Annual Report

Required

a. In total, how much did Second Cup’s cash and cash equivalents change during 2016? Was this an increase or a decrease? How did this compare with the previous year?

b. Did Second Cup have net income or a net loss in 2016? How did this compare with the cash flows from operating activities? What was the largest difference between these two amounts?

c. What effect did the change in the company’s accounts payable and accrued liabilities have on cash flows from operating activities in 2016? What does this tell you about the balance owed to these creditors?

d. Did the balance of outstanding gift cards increase or decrease during 2016? Was this considered to be an inflow or an outflow of cash?

e. Did Second Cup purchase property, plant, and equipment during 2016? Did the company receive any proceeds from the sale of property, plant, and equipment during the period?

f. Calculate Second Cup’s net free cash flow for 2016 and 2015. Is the trend positive or negative?

g. Second Cup’s total liabilities were $22,038 at December 31, 2016, and $22,558 at December 26, 2015. Determine the company’s cash flows to total liabilities ratio. Comment on the change year over year.

h. If you were a user of Second Cup’s financial statements—a banker or an investor—how would you interpret the company’s cash flow pattern? How would you assess the risk of a loan to or an investment in Second Cup? Do you think the company is growing rapidly?

Free Cash FlowFree cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley