(Future income taxes and pensions, LO 8) Orthez Inc. (Orthez) funds a defined- benefit pension plan for...

Question:

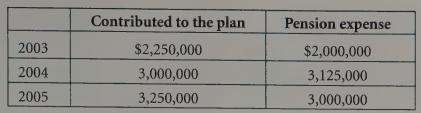

(Future income taxes and pensions, LO 8) Orthez Inc. (Orthez) funds a defined- benefit pension plan for its employees. The plan began in 2003. Contributions to the pension plan are made in accordance with actuarial assumptions, while the pension expense that Orthez records each year is determined in accordance with GAAP. In the first three years of the plan Orthez contributed to the plan and expensed for financial reporting purposes the following amounts:

Required:

a. Prepare the journal entry that Orthez would make each year to record the pension expense and the contribution to the pension plan.

b. What is the balance in the pension asset or liability account at the end of 2003 through 2005?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: