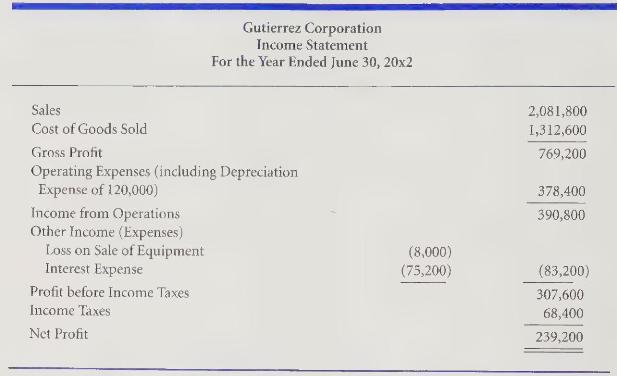

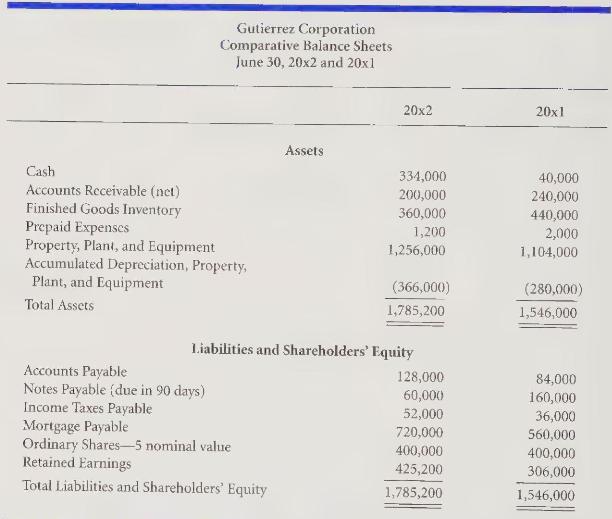

Gutierrez Corporation's (20 times 2) income statement and its comparative balance sheets as of June 30, LO

Question:

Gutierrez Corporation's \(20 \times 2\) income statement and its comparative balance sheets as of June 30, LO 6 The Cash Flow Statement-

LO 7 Direct Method \(20 \times 2\) and \(20 \times 1\) appear on the next page.

Additional information about \(20 \times 2\) is as follows:

(a) Equipment that cost 48,000 with accumulated depreciation of 34,000 was sold at a loss of 8,000 ;

(b) land and building were purchased in the amount of 200,000 through an increase of 200,000 in the mortgage payable;

(c) a 40,000 payment was made on the mortgage;

(d) the notes were repaid, but the company borrowed an additional 60,000 through the issuance of new notes payable; and

(e) a 120,000 cash dividend was declared and paid.

REQUIRED 1. Prepare a cash flow statement using the direct method. Include a supporting schedule of noncash investing and financing transactions.

2. What are the primary reasons for Gutierrez Corporation's large increase in cash from \(20 \times 1\) to \(20 \times 2\) ?

3. Calculate and assess cash flow yield and free cash flow for \(20 \times 2\).

LO 6 The Cash Flow Statement-

LO 7 Indirect Method

Step by Step Answer:

Financial Accounting A Global Approach

ISBN: 9780395839867

1st Edition

Authors: Sidney J. Gray, Belverd E. Needles