Here is the trial balance for Crown Advisory Services on July 31: The following information is also

Question:

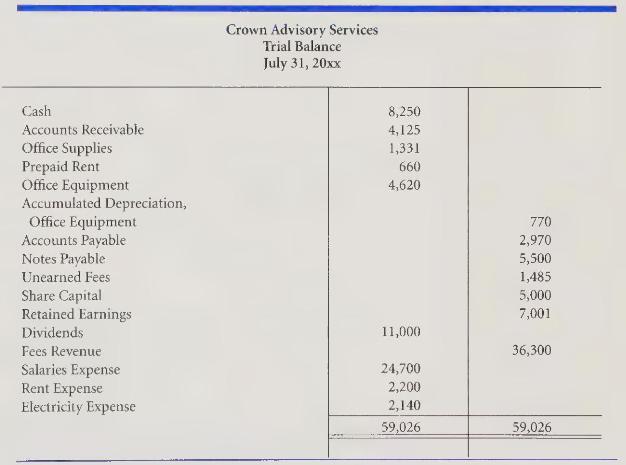

Here is the trial balance for Crown Advisory Services on July 31:

The following information is also available:

a. Ending inventory of office supplies, 132 .

b. Prepaid rent expired, 220 .

c. Depreciation of office equipment for the period, 330 .

d. Accrued interest expense at the end of the period, 275.

e. Accrued salaries at the end of the month, 165.

f. Fees still unearned at the end of the period, 583 .

g. Fees earned but unrecorded, 1,100 .

h. Estimated income taxes, 2,000.

1. Open \(\mathrm{T}\) accounts for the accounts in the trial balance plus the following: Fees Receivable; Interest Payable; Salaries Payable; Income Taxes Payable; Office Supplies Expense; Depreciation Expense, Office Equipment; Interest Expense; and Income Taxes Expense. Enter the balances.

2. Determine the adjusting entries and post them directly to the \(\mathrm{T}\) accounts.

3. Prepare an adjusted trial balance.

Step by Step Answer:

Financial Accounting A Global Approach

ISBN: 9780395839867

1st Edition

Authors: Sidney J. Gray, Belverd E. Needles