In July 2013, Yreka Platinum Mines Inc. (Yreka), a public company, began operation of its new platinum

Question:

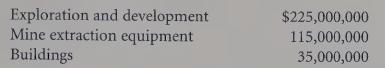

In July 2013, Yreka Platinum Mines Inc. (Yreka), a public company, began operation of its new platinum mine. Geologists estimate that the mine contains about 825,000 ounces of platinum. Yreka incurred the following capital costs in starting up the mine:

The exploration and development costs were incurred to find the mine and prepare it for operations. The extraction equipment should be useful for the entire life of the mine and could be sold for $10,500,000 when the mine is exhausted in 10 years. The buildings are expected to last much longer than the life of the mine, but they will not be useful once the mine is shut down. The production engineers estimate the following year-by-year production for the mine:

Yreka’s year-end is June 30.

Required:

a. Show the journal entries necessary to record the purchase of the extraction equipment and the construction of the buildings.

b. Prepare depreciation schedules using the straight-line, declining balance (20 percent per year), and unit-of-production methods for the three types of capital costs.

c. Which method would you recommend that Yreka use to depreciate its capital assets? Explain. Do you think the same method should be used for each type of capital asset? Explain.

d. The mine is viable as long as the cash cost of extracting the platinum remains below the price Yreka can obtain for its platinum. If the price falls below the cash cost of extraction, it may be necessary to close the mine temporarily until prices rise. What would be the effect on depreciation if the mine were temporarily shut down?

e. Under some circumstances it may become necessary to shut the mine permanently.

How would you account for the capital assets if the mine had to be shut down permanently? Show the journal entries you would make in regard to the capital assets in this event. State any assumptions you make.

Step by Step Answer: