Manitoba Manufacturing Inc. (MMI) has a loan from the Canadian National Bank to help finance its working

Question:

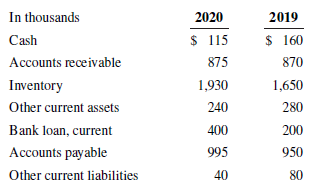

Manitoba Manufacturing Inc. (MMI) has a loan from the Canadian National Bank to help finance its working capital. The terms of the loan are that the bank will lend MMI an amount up to 33% of its inventory balance and 50% of its accounts receivable. One of the loan covenants requires that MMI maintain a current ratio greater than 2.0. Information related to MMI’s current assets and current liabilities is shown in the following table:

Required

a. Does MMI satisfy the loan covenant in both years?

b. Based on the loan size requirement only of the loan covenant, what is the maximum amount of loan MMI could borrow in each year?

c. Based on a review of the accounts receivable balances, do you think sales have grown for MMI in 2020 over 2019?

d. Identify three different ways management could have “managed” the statement of financial position to ensure that MMI met the loan covenant in 2020.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley