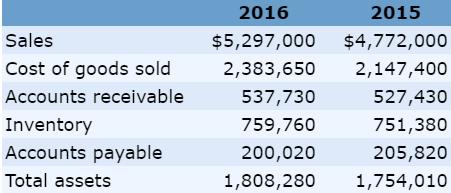

The following financial information is for Ambroise Industries Inc.: Ambroise is a distributor of auto parts operating

Question:

The following financial information is for Ambroise Industries Inc.:

Ambroise is a distributor of auto parts operating in eastern Ontario that offers 30-day terms and has all sales on credit. The company has a large inventory due to the number of parts it stocks for different makes and models of cars. Most of its suppliers off er terms of 30 days, and Ambroise tries to stay on good terms with its suppliers by paying on time.

Required

a. What is the average time it takes Ambroise to collect its accounts receivable? How does that compare with the credit terms that the company offers?

b. What is the average length of time that it takes Ambroise to sell through its inventory?

c. What is the average length of time that it takes Ambroise to pay its payables? How does that compare with the credit terms it is offered?

d. The cash-to-cash cycle is the length of time from when a company purchases an item of inventory to when it collects cash from its sale, reduced by the days it takes to pay the related accounts payable. How long is Ambroise’s cash-to-cash cycle?

e. Assume that Ambroise finances its inventory with a working capital loan from the bank. If Ambroise could improve its inventory management system and reduce the days to sell inventory to an average of 50 days, how much lower would the company’s bank loan be?

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley