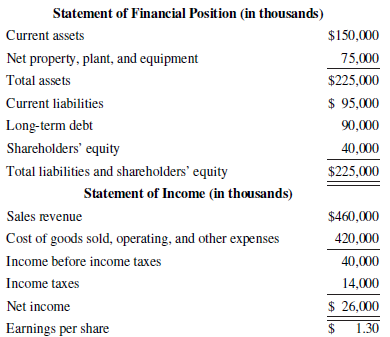

Manonta Sales Companys summary statement of financial position and income statement as at December 31, 2020, follow.

Question:

Manonta Sales Company’s summary statement of financial position and income statement as at December 31, 2020, follow.

The long-term debt has an interest rate of 6% and is convertible into 9 million common shares. After carefully analyzing all available information about Manonta, you decide the following events are likely to happen.

1. Manonta will increase its income before income taxes by 10% next year because of increased sales.

2. The eff ective tax rate will stay the same.

3. The holders of long-term debt will convert it into shares on January 1, 2021.

4. The current price/earnings ratio of 20 will increase to 24 if the debt is converted, because of the reduced risk.

You own 100 common shares of Manonta and are trying to decide whether you should keep or sell them. You decide you will sell the shares if you think their market price is not likely to increase by at least 10% next year.

Required

Based on the information available, should you keep the shares or sell them? Support your answer with a detailed analysis.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley