Metro Inc. is one of Canadas leading food retailers and distributors and operates a network of supermarkets,

Question:

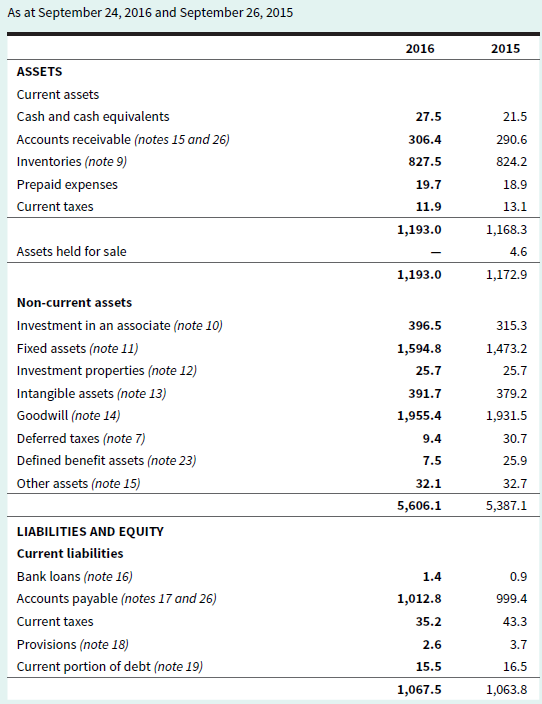

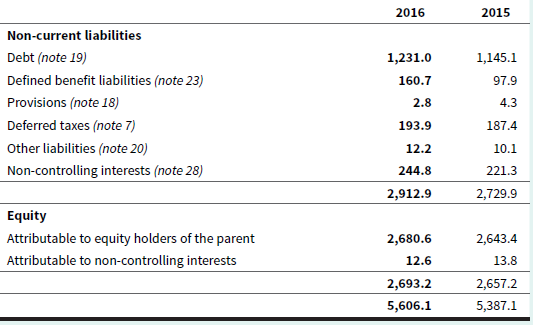

Metro Inc. is one of Canada’s leading food retailers and distributors and operates a network of supermarkets, discount stores, and drugstores. Exhibit 10.9A includes the company’s statement of financial position and Exhibit 10.9B includes Note 19 to the company’s 2016 financial statements, which provides details of Metro’s debt. Amounts are in millions of dollars.

EXHIBIT 10.9A Metro Inc.’s 2016 Consolidated Statements of Financial Position

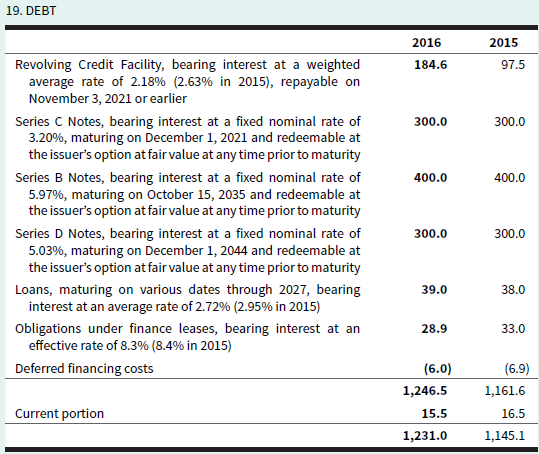

EXHIBIT 10.9B Excerpt from Metro Inc.’s 2016 Annual Report

The revolving credit facility with a maximum of $600.0 bears interest at rates that fluctuate with changes in bankers’ acceptance rates and is unsecured. As at September 24, 2016, the unused authorized revolving credit facility was $415.4 ($502.5 as at September 26, 2015). Given that the Corporation frequently increases and decreases this credit facility through bankers’ acceptances with a minimum of 30 days and to simplify its presentation, the Corporation found that it is preferable for the understanding of its financing activities to present the consolidated statement of cash flows solely with net annual changes. As at September 24, 2016, the revolving credit facility included loans of $95.0 US (nil as at September 26, 2015). On September 1, 2016, the maturity of the revolving credit facility was extended to November 3, 2021.

The amortization of deferred financing fees and the debt related to the acquisition of intangible assets, excluded from the consolidated statements of cash flows, totalled $5.2 in 2016 ($14.0 in 2015).

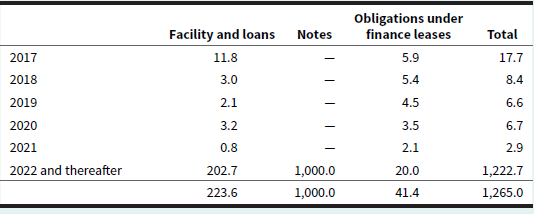

Repayments of debt in the upcoming fiscal years will be as follows:

The minimum payments in respect of the obligations under finance leases included interest amounting to $12.5 on these obligations in 2016 ($14.9 in 2015).

Required

a. Metro Inc. had a $600-million revolving credit facility in place at September 24, 2016. What is a revolving credit facility?

b. The revolving credit facility is described as unsecured. What does this mean?

c. The company also had $1 billion in notes outstanding (Series B, C, and D notes) at September 24, 2016. When do these notes have to be repaid to the note holders?

d. What is the annual interest expense that Metro Inc. incurs on the $1 billion in outstanding notes?

e. Metro Inc. has a number of objectives in relation to its management of capital. One of these objectives is to have a percentage of interest-bearing, non-current debt to total combined interest-bearing, non-current debt and equity (non-current debt/total capital ratio) of less than 50%. Did the company meet this in 2016? Explain why Metro may have this objective.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley