Note 17 to the March 31, 2017, financial statements of Canada Goose Holdings Inc. is shown in

Question:

Note 17 to the March 31, 2017, financial statements of Canada Goose Holdings Inc. is shown in Exhibit 11.11. All dollar amounts are in thousands.

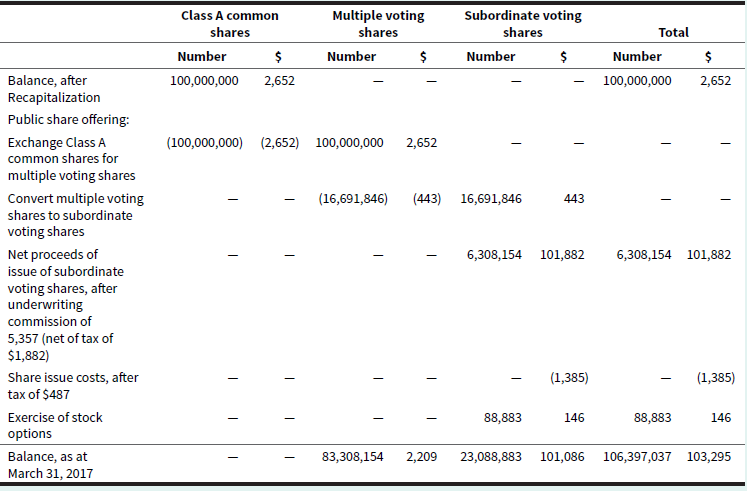

EXHIBIT 11.11 Excerpt from Canada Goose Holdings Inc.’s 2017 Annual Consolidated Financial Statements

NOTE 17. SHAREHOLDERS’ EQUITY

The authorized and issued share capital of the Company is as follows:

Authorized

The authorized share capital of the Company consists of an unlimited number of subordinate voting shares without par value, an unlimited number of multiple voting shares without par value, and an unlimited number of preferred shares without par value, issuable in series.

Issued

Multiple voting shares—Holders of the multiple voting shares are entitled to 10 votes per multiple voting share. Multiple voting shares are convertible at any time at the option of the holder into one subordinate voting share. The multiple voting shares will automatically be converted into subordinate voting shares when they cease to be owned by one of the principal shareholders. In addition, the multiple voting shares of either of the principal shareholders will automatically be converted to subordinate voting shares at such time as the beneficial ownership of that shareholder falls below 15% of the outstanding subordinate voting shares and multiple voting shares outstanding, or in the case of DTR, when the President and Chief Executive Officer no longer serves as an officer or director of the Company.

Subordinate voting shares—Holders of the subordinate voting shares are entitled to one vote per subordinate voting share. The rights of the subordinate voting shares and the multiple voting shares are substantially identical, except for voting and conversion. Subject to the prior rights of any preferred shares, the holders of subordinate and multiple voting shares participate equally in any dividends declared, and share equally in any distribution of assets on liquidation, dissolution, or winding up.

Share capital transactions in connection with the public share off ering are as follows:

Required

a. Describe the differences between the multiple voting shares and subordinate voting shares with respect to the following:

i. Their ability to influence the selection of management and to influence company decision-making

ii. The amount and priority of expected dividends

b. If you owned 100,000 multiple voting shares at March 31, 2017, what proportion of total votes would you control? If you owned 100,000 subordinate voting shares, what proportion of total votes would you control?

c. Why would investors choose to purchase the multiple voting shares rather than the subordinate shares? Or vice versa?

d. Why might holders of multiple voting shares choose to convert their shareholdings into subordinate shares, as described under the heading “Issued”?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley