(NPV) Georgia Mechanical has been approached by one of its customers about producing 400,000 special-purpose parts for...

Question:

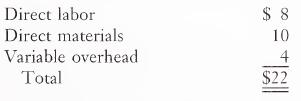

(NPV) Georgia Mechanical has been approached by one of its customers about producing 400,000 special-purpose parts for a new farm implement product. The parts would be required at a rate of 50,000 per year for 8 years. To provide these parts, Georgia Mechanical would need to acquire several new production machines. These machines would cost $500,000 in total. The customer has of¬ fered to pay Georgia Mechanical $50 per unit for the parts. Managers at Georgia Mechanical have estimated that, in addition to the new machines, the company would incur the following costs to produce each part.

In addition, annual fixed (out-of-pocket) costs would be $40,000. The new ma¬ chinery would have no salvage value at the end of its 8-year life. The company uses a discount rate of 8 percent to evaluate capital projects.

a. Compute the net present value of the machine investment (ignore tax).

b. Based on the NPV computed in part

a, is the machine a worthwhile invest¬ ment? Explain.

c. Aside from the NPV, what other factors should Georgia Mechanical’s man¬ agers consider in making the investment decision?

Step by Step Answer: