On November 15, 2014 Desert Renovations Ltd. (Desert) signed a contract to renovate a 75-year-old building to

Question:

On November 15, 2014 Desert Renovations Ltd. (Desert) signed a contract to renovate a 75-year-old building to be suitable to house the head office of a real estate company. Desert has provided you with the following information about the contract:

i. Desert expects the renovations to take three years.

i. Desert will receive $10,000,000 for the renovations on the following schedule:

* $2,500,000 when the contract is signed

* $3,000,000 on September 1, 2015

* $3,000,000 on June 1, 2016, the expected completion date of the project

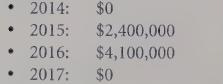

* $1,500,000 on January 15, 2017 iii. The total cost of the renovations is expected to be $6,500,000, incurred as follows:

iv. Other costs associated with the contract are $700,000 in each of 2015 and 2016.

These costs are treated as period costs in the calculation of income.

v. Desert’s year-end is December 31.

Required:

a. Calculate revenue, expenses, gross margin, and net income for each year using the following revenue recognition methods:

i. Percentage-of-completion i. Zero-profit iil. Cash collection (Hint: Match construction costs based on the proportion of cash collected in each year.)

b. Calculate the gross margin percentage and the profit margin percentage for each year.

c. Does it matter how Desert accounts for its revenue from the renovation contract?

To whom does it matter and why?

d. Is the actual economic performance of Desert affected by how it accounts for the revenue from the renovation contract? Explain.

Step by Step Answer: