One controversial accounting issue is accounting for research costs. IFRS require research costs to be expensed as

Question:

One controversial accounting issue is accounting for research costs. IFRS require research costs to be expensed as incurred. Some people argue that research is a legitimate asset and expensing it results in an understatement of assets and income, violates matching, making companies that invest heavily in research appear less successful than they actually are.

Chortitz Ltd. (Chortitz) is a large and successful software development company.

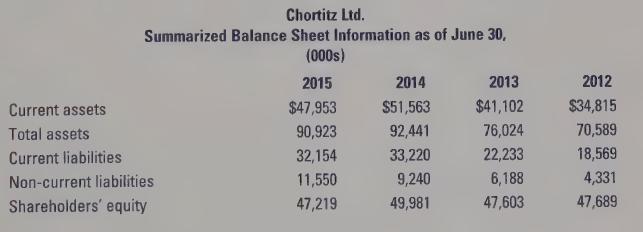

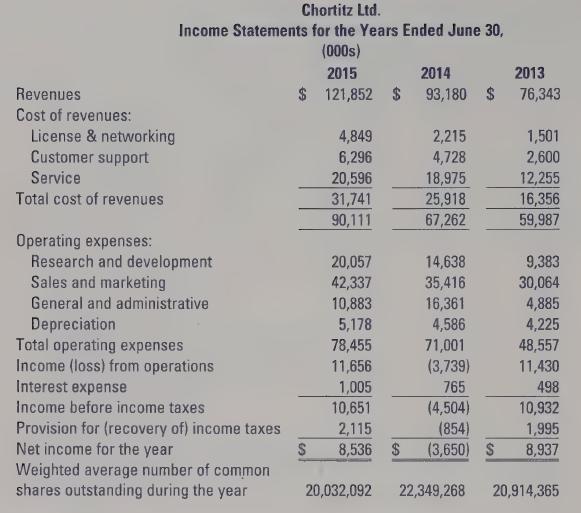

You have been provided with Chortitz’s balance sheets for 2012 through 2015 and income statements for 2013 through 2015. Chortitz expensed (and expended)

$7,906,000 for research in 2011 and $6,612,000 in 2012.

Required:

a. Recalculate Chortitz’s net income in 2013, 2014, and 2015, assuming research is capitalized and amortized over three years. Also calculate total assets and shareholders’

equity, assuming research is capitalized and amortized. What amount would be reported on the balance sheet for research in this case? (Assume that onethird of the amount expended on research is expensed each year, including the year of the expenditure, and that the accounting for research and development has no effect on income taxes.)

b. Calculate Chortitz’s profit margin ratio, interest coverage ratio, earnings per share, debt-to-equity ratio, ROA, and ROE for 2013, 2014, and 2015 using the information as presented in the company’s financial statements. Calculate the same ratios, assuming that Chortitz capitalizes and amortizes its research costs over three years.

c. Evaluate the performance and solvency of Chortitz under the “expense” and “capitalize”

scenarios. What are the implications of the differences between the two scenarios? Do you think there is merit in the criticisms some people have expressed about the current IFRS treatment of research costs? Explain fully.

Step by Step Answer: