Opeongo Construction Ltd. (Opeongo) is a recently formed company that builds commercial and industrial buildings in the

Question:

Opeongo Construction Ltd. (Opeongo) is a recently formed company that builds commercial and industrial buildings in the Ottawa area. All of Opeongo’s common stock is owned by five people: Adam and Nikki, a brother and sister who operate the company; two cousins of Adam and Nikki who live and work in Vancouver; and a wealthy aunt who is retired and lives in Europe. Opeongo borrowed money from the bank to cover the costs of starting the business. All the money initially borrowed from the bank has been spent.

In October 2013, Opeongo won a contract to build a warehouse in suburban Ottawa. This will be its first large job. The warehouse will take about 18 months to build and construction is scheduled to begin in late March 2014. Opeongo will receive

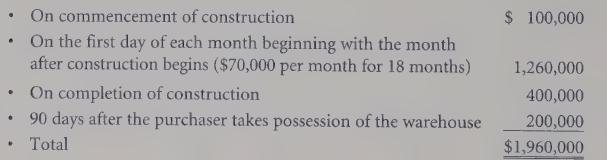

$1.96 million to build the warehouse. The contract specifies the following payment schedule:

From this amount Opeongo has to pay the costs of construction, which it estimates to be about $1,500,000. Construction costs are expected to be incurred evenly over the construction period. Opeongo’s year-end is December 31.

Required:

a. What do you think Opeongo’s objectives of accounting could be? Explain.

b. How would you rank the objectives? Explain.

c. What different revenue recognition methods could Opeongo consider for the warehouse project? How much revenue would be recognized in 2013, 2014, and 2015 under the different methods you identified? Show your work.

d. When would you recommend that revenue be recognized on the warehouse construction project? Explain your recommendation. Make sure that you consider the constraints, facts, and objectives in your answer.

Step by Step Answer: