(Performance measures and suboptimization) Myron Stiles is a division manager of Birmingham Rubber Products. He is presently...

Question:

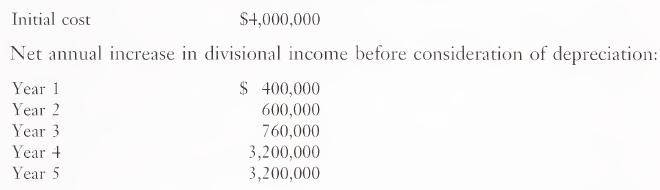

(Performance measures and suboptimization) Myron Stiles is a division manager of Birmingham Rubber Products. He is presently evaluating a potential revenue¬ generating investment that has the following characteristics:

The project would have a 5-year life with no salvage value. All assets are depre¬ ciated according to the straight-line method. Myron is evaluated and compen¬ sated based on the amount of pretax profit his division generates. More precisely, he receives an annual salary of $150,000 plus a bonus equal to 8 percent of divisional segment income. Before consideration of the above project, Myron anticipates that his division will generate $4,600,000 in pretax profit.

a. Compute the effect of the new investment on the level of divisional pretax profits for years 1 through 5.

b. Determine the effect of the new project on Myron’s compensation for each of the five years.

c. Based on your computations in part

b, will Myron be hesitant to invest in the new project? Explain.

d. Would upper management likely view the new investment favorably? Explain.

Step by Step Answer: