Preakness Consulting and Bellevue Services are two petroleum engineering firms located in Calgary. Both companies are very

Question:

Preakness Consulting and Bellevue Services are two petroleum engineering firms located in Calgary. Both companies are very successful and are looking to attract additional investors to provide them with an infusion of capital to expand. In the past year, both companies had consulting revenue of $1.5 million each. On January 1, 2020, both companies purchased new computer systems. Currently, the only other asset owned by the companies is office equipment, which is fully depreciated. The computer systems, related hardware, and installation cost each company $660,000, and the systems have an expected life of five years. The residual value at the end of the five-year period is expected to be $30,000 in each case.

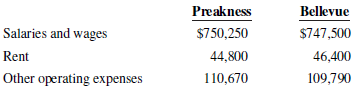

Preakness has chosen to depreciate the computer equipment using the straight-line method, while Bellevue has taken a more aggressive approach and is depreciating the system using the double-diminishing-balance method. Both companies have a December 31 year end and a tax rate of 25%. Information on their other expenses is as follows:

Required

a. For each company, prepare a depreciation schedule showing the amount of depreciation expense to be charged each year for the computer system.

b. Prepare statements of income for the current year for both companies.

c. How might an unsophisticated investor interpret the financial results from part “b”? Is one company really more profitable than the other?

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley