(Probabilities; Appendix 3) Gulf Coast Marine Company is comparing the invest ment profiles of two projects. The...

Question:

(Probabilities; Appendix 3) Gulf Coast Marine Company is comparing the invest¬ ment profiles of two projects. The first project is a shrimp boat that costs $500,000 and provides net annual after-tax cash flows of $80,000. The life of the boat is 10 years. The second project is an $850,000 yacht that can be rented to corporate executives for meetings and parties. The yacht has a useful life of 8 years and is expected to produce annual after-tax cash flows of $165,000. Gulf Coast Marine Company uses a cost of capital rate of 11 percent to determine net present values.

a. Using an incremental approach, determine which of the two investments is the better choice for Gulf Coast Marine.

b. If the returns from the yacht are expected to be only $150,000 each year for 8 years, which is the better project?

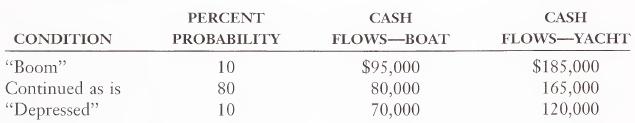

c. The returns of each project are probabilistic. The probabilities are related to how well or how poorly the oil business does. If the oil business “booms,” people will have more money, the selling price of shrimp will rise, and the yacht will be rented more often. Below are probabilities associated with changes in the oil business and how those changes will affect the returns from the projects:

What is the total expected value for each project?

d. Using the expected value from part

c, compute the standard deviation and the coefficient of variation for the two projects.

Step by Step Answer: