(Appendix 3) Manhattan Office Systems is comparing two projects (X and Y), each of which requires investments...

Question:

(Appendix 3) Manhattan Office Systems is comparing two projects (X and Y), each of which requires investments of $80,000, produces expected after-tax an¬ nual cash flows of $18,000, and will last 9 years. Discounting the expected cash flows at 9 percent, the company’s cost of capital yields the same net present value for each project.

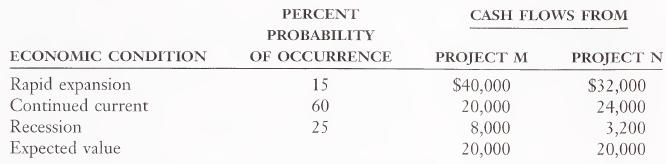

Corporate president, Bill Henson, believes, however, that the levels of an¬ nual cash inflows each year will differ between the two projects depending on economic conditions. He constructed the following schedule to reflect his as¬ sessment of cash flows under various conditions:

a. Calculate the standard deviation of the range of cash flows for each project.

b. Calculate the coefficient of variation for each project.

c. Discuss which project is more desirable and provide reasons for your choice.

Step by Step Answer: