(Comprehensive; Appendix 2) The management of Westlake Manufacturing Com pany is evaluating a proposal to purchase a...

Question:

(Comprehensive; Appendix 2) The management of Westlake Manufacturing Com¬ pany is evaluating a proposal to purchase a new turning lathe as a replacement for a less efficient piece of similar equipment that would then be sold. The cost of the new lathe including delivery and installation is $175,000. If the equipment is purchased, Westlake will incur $5,000 of costs in removing the present equip¬ ment and revamping service facilities. The present equipment has a book value of $100,000 and a remaining useful life of 10 years. Due to new technical im¬ provements that have made the equipment outmoded, it presently has a resale value of only $40,000.

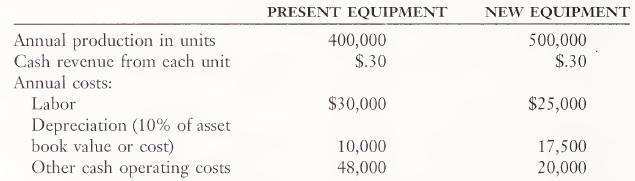

Management has provided you with the following comparative manufac¬ turing cost tabulation:

Management believes that if the equipment is not replaced now, the com¬ pany must wait 7 years before replacement is justified. The company uses a 15 percent discount or hurdle rate in evaluating capital projects and expects all capital project investments to recoup their costs within 5 years.

Both pieces of equipment are expected to have a negligible salvage value at the end of 10 years.

a. Determine the net present value of the new equipment (ignore tax).

b. Determine the internal rate of return on the new equipment (ignore tax).

c. Determine the payback period for the new equipment (ignore tax).

d. Determine the accounting rate of return for the new equipment (ignore tax).

e. Using an incremental approach, determine whether the company should keep the present equipment or purchase the new.

Step by Step Answer: