(Appendix 2; payback; NPV) Fullerton Department Stores is a growing business that is presently considering adding a...

Question:

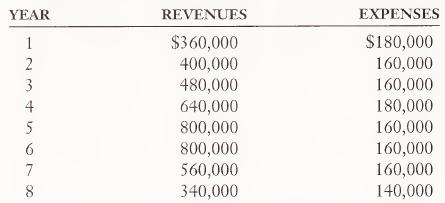

(Appendix 2; payback; NPV) Fullerton Department Stores is a growing business that is presently considering adding a new product line. The firm would be required by the manufacturer to incur setup costs of $800,000 to handle the new product line. Fullerton has estimated that the product line would have an ex¬ pected life of 8 years. Following is a schedule of revenues and annual fixed operating expenses (including $100,000 of annual depreciation on the invest¬ ment) associated with the new product line. Variable costs are estimated to av¬ erage 65 percent of revenues. All revenues are collected as earned. All expenses shown, except for the included amount of straight-line depreciation, are paid in cash when incurred.

The company has a cost of capital of 12 percent. Management uses this rate in discounting cash flows for evaluating capital projects.

a. Calculate the accounting rate of return (ignore tax).

b. Calculate the payback period (ignore tax).

c. Calculate the net present value (ignore tax).

Step by Step Answer: