(Profit center performance) Frona Greene, the head of the accounting department at Mammoth State Elniversity has felt...

Question:

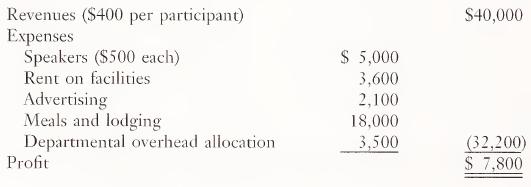

(Profit center performance) Frona Greene, the head of the accounting department at Mammoth State Elniversity has felt increasing pressure to raise external mon¬ ies to compensate for dwindling state financial support. Accordingly, in early January 1998, she conceived the idea of offering a three-day accounting work¬ shop on income taxation for local CPAs. She asked Mel Price, a tenured tax professor, to supervise the planning process for the seminar, which was to be held in late March 1998. In early February, Professor Price presented Ms. Greene with the following budget plan:

Explanations of budget items: The facilities rent of $3,600 is a fixed rental, which is to be paid to a local hotel for use of its meeting rooms. The advertising is also a fixed budgeted cost. Meal expense is budgeted at $5 per person per meal (a total of 9 meals are to be provided for each participant); lodging is budgeted at the rate of $45 per participant per night. The departmental overhead includes a specific charge for supplies costing $10 for each participant as well as a general allocation of $2,500 for use of departmental secretarial resources. After reviewing the budget, Ms. Greene gave Professor Price approval to proceed with the seminar.

a. Recast the above income statement in a segment margin income statement o o format.

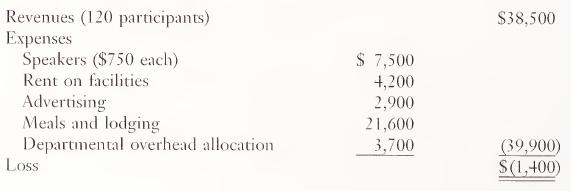

b. Assume the actual financial results of the seminar were as follows:

Explanation ofactual results: Because signups were running below expectations, the seminar fee was reduced from $400 to $300 for late enrollees and ad¬ vertising expense was increased. In budgeting for the speakers, Professor Price neglected to include airfare, which averaged $250 per speaker. After the fees were reduced and advertising increased, the number of participants grew and was larger than expected; therefore, a larger meeting room had to be rented from the local hotel. Recast the actual results in a segment margin income format.

c. Compute variances between the budgeted segment margin income statement and the actual segment income statement. Identify and discuss the factors that are primarily responsible for the difference between the budgeted profit and the actual loss on the tax seminar.

Step by Step Answer: