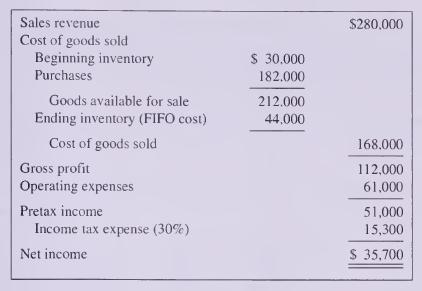

Smart Company prepared its annual financial statements dated December 31, 2004. The compain applies the FIFO inventory

Question:

Smart Company prepared its annual financial statements dated December 31, 2004. The compain applies the FIFO inventory costing method; however, the company neglected to appl\ LCM to the ending inventory. The preliminary 2004 income statement follows

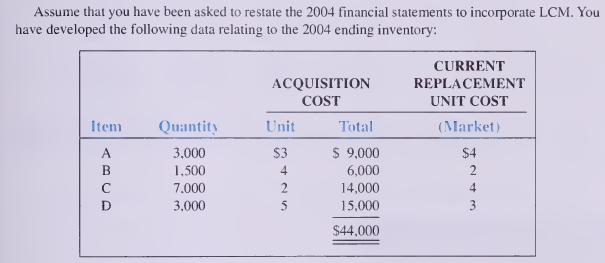

Required: 1. Restate this income statement to reflect LCM valuation of the 2004 ending inventory. Apply LCM on an itenvby-item basis and show computations. 2. Compare and explain the LCM effect on each amount that was changed in requirement 1

. 3. What is the conceptual basis for applying LCM to merchandise inventories? 4. Thought question: What effect did LCM have on the 2004 cash flow? What will be the long-term effect on cash flow?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: