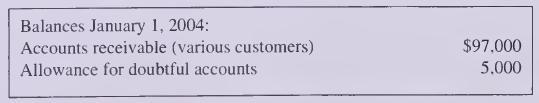

The following data were selected from the records of Fluwars Company for the year ended December 31,2004.

Question:

The following data were selected from the records of Fluwars Company for the year ended December 31,2004.

In the following order, except for cash sales, the company sold merchandise and made collections on credit terms 3/10, n/30 (assume a unit sales price of $400 in all transactions and use the gross method to record sales revenue).

Transactions during 2004

a. Sold merchandise for cash, $1 22,000.

b. Sold merchandise to Abbey Corp; invoice price. $6,800.

c. Sold merchandise to Brown Company; invoice price, S14,000.

d. Abbey paid the invoice in

(b) within the discount period.

e. Sold merchandise to Cavendish Inc; invoice price, $12,400.

f. Two days after paying the account in full, Abbey returned four defective units and received a cash refund.

g. Collected $78,000 cash from customer sales on credit in prior year, all within the discount periods.

h. Three days after purchase date. Brown returned two of the units purchased in

(c) and received account credit.

i. Brown paid its account in full within the discount period.

j. Sold merchandise to Decca Corporation; invoice price, $9,000.

k. Cavendish paid its account in full after the discount period.

I. Wrote off a 2003 account of $ 1 ,600 after deciding that the amount would never be collected.

m. The estimated bad debt rate used by the company was 2 percent of credit sales net of returns.

Required: 1. Using the following categories, indicate the effect of each listed transaction, including the writeoff of the uncollectible account and the adjusting entry for estimated bad debts (ignore cost of goods sold). 2. Show how the accounts related to the preceding sale and collection activities should be reported on the 2004 income statement. (Treat sales discounts as a contra-revenue.)

2. Show how the accounts related to the preceding sale and collection activities should be reported on the 2004 income statement. (Treat sales discounts as a contra-revenue.)

Step by Step Answer: