The following note was contained in a recent DaimlerChrysler Corporation annual report: Inventories valued on the LIFO

Question:

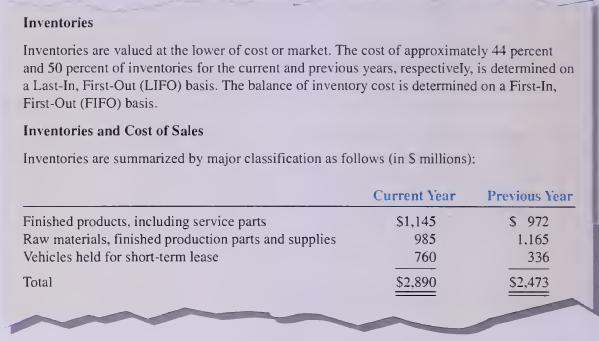

The following note was contained in a recent DaimlerChrysler Corporation annual report:

Inventories valued on the LIFO basis would have been SI 60 million and SI 23 million higher than reported had they been valued on the FIFO basis at December 3 1 of the current year and previous year, respectively.

Total automotive manufacturing cost of sales aggregated S27.2 billion and S26.3 billion for the current year and previous year, respectively.

Required: 1. Determine the ending inventor)' that would have been reported in the current year if Daimler-

Chrysler had used only FIFO. 2. Determine the cost of goods sold that would have been reported if DaimlerChrysler had used only FIFO for both years. 3. Explain why DaimlerChrysler management chose to use LIFO for certain of its inventories.

Step by Step Answer: