The following questions pertain to Couche-Tards long-term debt: a. How much long-term debt was outstanding on April

Question:

The following questions pertain to Couche-Tard’s long-term debt:

a. How much long-term debt was outstanding on April 26, 2009? How much of that long-term debt was classified as current? What does it mean when long-term debt is classified as a current liability? What is the purpose of classifying long-term debt as current?

b. How much did Couche-Tard have outstanding from its term revolving operating credit agreements on April 26, 2009? How much of the amount is in Canadian dollars and how much is in U.S. dollars? What were the effective interest rates in 2009 and 2008 on the Canadian and U.S. portions of the loans? Why do you think Couche-Tard has both Canadian and U.S. dollar loans? What types of restrictions are on these loans?

c. How much did Couche-Tard have outstanding from its subordinated unsecured debt on April 26, 2009? When does this debt mature? What is the interest rate on the debt?

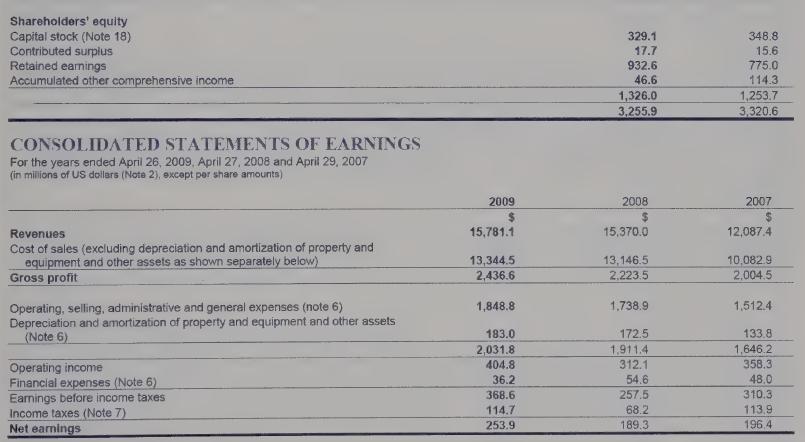

d. What was Couche-Tard’s interest expense in 2007, 2008, and 2009? How much interest did Couche-Tard pay in those years? Why are the interest expense and the amount of interest paid different?

e. How much is scheduled to.be repaid to lenders in each of the next five years? In examining the scheduled repayments do you have any concerns? Explain.

Alimentation Couche-Tard Inc. (Couche-Tard) is a Canadian convenience store operator with a network of over 2,000 stores:in Canada and more than 3,000 stores in the U.S. Over 3,600 of the total number are company-operated and the rest operate under an affiliate program. The company sells fuel in 65 percent of its company-operated stores. The stores are primarily operated under the Couche-Tard and Mac’s trademarks in Canada and the Circle K trademark in the U.S.

In addition to the North American Couche-Tard network, there are approximately 3,500 Circle K-licensed stores in other parts of the world."

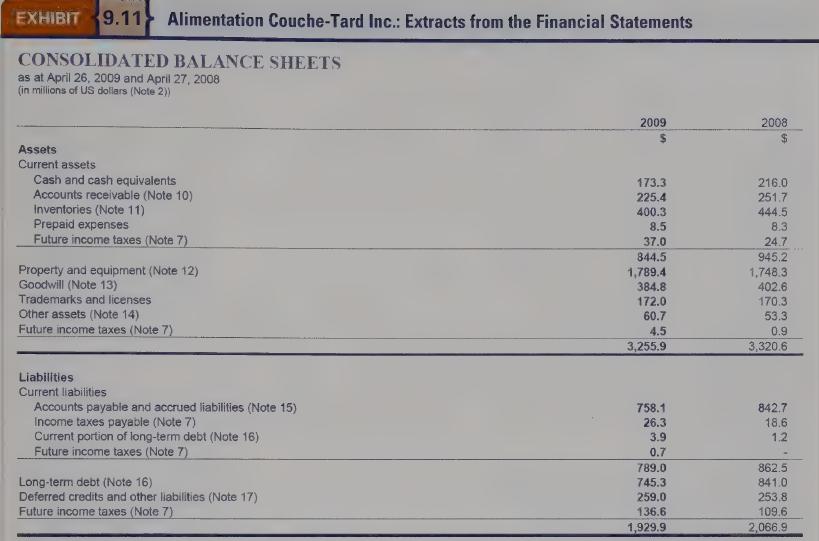

Couche-Tard’s consolidated balance sheets and statements of earnings as well as extracts from the statements of cash flows and notes to the financial statements from its 2009 annual report are provided in Exhibit 9.11.'

Step by Step Answer: