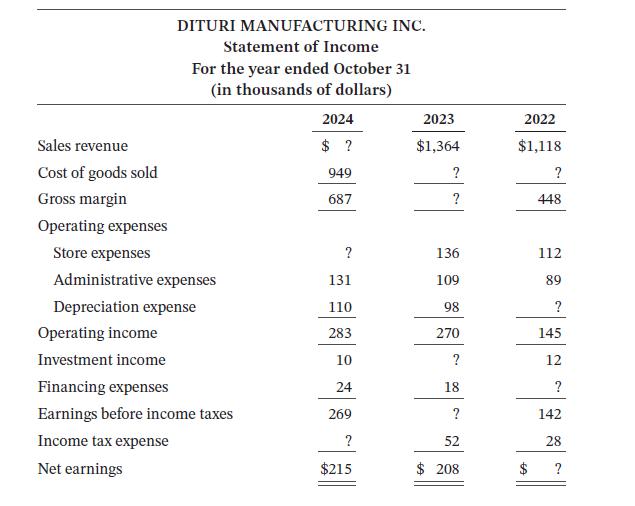

The statement of income for DiTuri Manufacturing Inc. for the years 2022 to 2024 is presented below.

Question:

The statement of income for DiTuri Manufacturing Inc. for the years 2022 to 2024 is presented below.

Required

Calculate the missing amounts on the statement of income.

Transcribed Image Text:

Sales revenue Cost of goods sold Gross margin Operating expenses Store expenses DITURI MANUFACTURING INC. Statement of Income For the year ended October 31 (in thousands of dollars) 2024 $ ? 949 687 Administrative expenses Depreciation expense Operating income Investment income Financing expenses Earnings before income taxes Income tax expense Net earnings ? 131 110 283 10 24 269 ? $215 2023 $1,364 ? ? 136 109 98 270 ? 18 ? 52 $ 208 2022 $1,118 ? 448 112 89 ? 145 12 ? 142 28 $ ?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 90% (10 reviews)

2024 Sales Revenue Gross margin 687 COGS 949 1636 Store expenses Gross margin 687 Operating i...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley

Question Posted:

Students also viewed these Business questions

-

The statement of income for DiTuri Manufacturing Inc. for the years 2018 to 2020 is presented below. Required Calculate the missing amounts on the statement of income. DITURI MANUFACTURING INC....

-

The consolidated statement of income for Ford Motor Company appears below. 1. What do you notice about the way revenues and expenses are partitioned? 2. For the Automotive division, compute the ratio...

-

The consolidated statement of income for Ford Motor Company appears below. Net income/(loss) attributable to ford motor company Amounts per share attributable to ford motor company common and class B...

-

6. Using the information provided above calculate the Rate of Return on Farm Assets (ROFA) for 2017 and 2018 Assets Current assets Noncurrent assets Liabilities Current liabilities Noncurrent...

-

In accounting terms, distinguish between intangibles and goodwill on a balance sheet. Why do these two items generally stay the same on projected financial statements?

-

What is the cost of capital equal to?

-

Helena Chocolate Products Ltd is considering the introduction of a new chocolate bar into its range of chocolate products. The new chocolate bar will require the purchase of a new piece of equipment...

-

A company sells a building with a cost of $350,000 and accumulated depreciation of $270,000 and records the entry for the sale as follows: Required a. Did the company prepare the entry correctly? If...

-

I don't understand why "decrease in bond premium" is under the assets and liabilities. The accounting records of EZ Company provided the data below. $68,050 15,550 5,775 Net income Depreciation...

-

The statement of income for Primitivo Winery Inc. for the years 2022 to 2024 is presented below. Required Calculate the missing amounts on the statement of income. Sales revenue Cost of goods sold...

-

Beach Life Ltd. operates an online booking service restricted to beachfront properties around the world. Users of the companys website booked beach rentals totalling $7.8 million in 2024. Bookings...

-

A company purchased a patent 4 years ago, and was amortizing that patent over a 10-year useful life. In the current year, the company determined the patent had become worthless. The write-off of the...

-

Section Three Answer the questions below 1.While pulling out of her driveway, Bethany becomes distracted by a bee and strikes Melanie, who is riding past on a bicycle. Bethany suffers serious injury...

-

A __________ is a schedule periodic check of a specific process behavior. Question 1Answer A. Widget B. Dashboard C. Monitor D. Process ID

-

1. Was VAAF contractually obligated to pay Chad for refraining from smoking? 2. Was there consideration to support its promise to pay $500? 3. Are there other facts you need to know to make that...

-

Presented here are the comparative balance sheets of Hames Incorporated at December 31, 2023 and 2022. Sales for the year ended December 31, 2023, totaled $1,700,000.%0D%0A%0D%0AHAMES...

-

McDonald's conducts operations worldwide and is managed in two primary geographic segments: US, and International Operated Markets, which is comprised of Australia, Canada, France, Germany, Italy,...

-

Mr. Williams is employed by BDF Inc. Compute BDFs 2018 employer payroll tax with respect to Mr. Williams assuming that: a. His annual compensation is $60,000. b. His annual compensation is $200,000.

-

Find a least expensive route, in monthly lease charges, between the pairs of computer centers in Exercise 11 using the lease charges given in Figure 2. a) Boston and Los Angeles b) New York and San...

-

Explain why dividends do not appear on the statement of income.

-

A. J. Smith Company started business on January 1, 2020, and the following transactions occurred in its first year: 1. On January 1, the company issued 12,000 common shares at $25 per share. 2. On...

-

You are part of a group of students analyzing a companys financial statements for a class project. At a team meeting, one of your group members makes the following statement: After reviewing the...

-

A stock is expected to pay a dividend of $1.50 at the end of the year (i.e., D 1 = $1.50), and it should continue to grow at a constant rate of 10% a year. If its required return is 14%, what is the...

-

The Hobby Shop has a checking account with a ledger balance of $1,700. The firm has $2,400 in uncollected deposits and $4,200 in outstanding checks. What is the amount of the disbursement float on...

-

An investment will pay you $34,000 in 11 years. If the appropriate discount rate is 6.1 percent compounded daily, what is the present value? (Use 365 days a year. Do not round intermediate...

Study smarter with the SolutionInn App