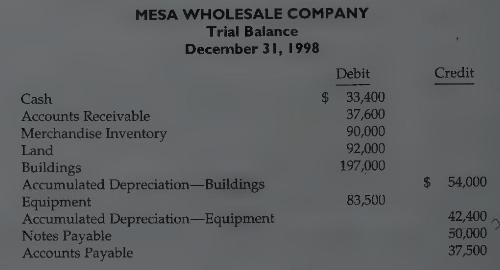

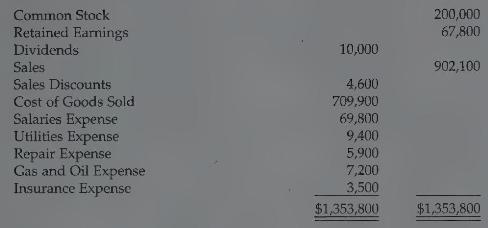

The trial balance of Mesa Wholesale Company contained the following aecounts at December 31, the end of

Question:

The trial balance of Mesa Wholesale Company contained the following aecounts at December 31, the end of the company's fiscal year:

Adjustment data:

1. Depreciation is \(\$ 10,000\) on buildings and \(\$ 9,000\) on equipment. (Both are administrative expenses.)

2. Interest of \(\$ 7,000\) is due and unpaid on notes payable at December 31 .

\section*{Other data:}

1. Salaries are \(80 \%\) selling and \(20 \%\) administrative.

2. Utilities expense, repair expense, and insurance expense are \(100 \%\) administrative.

3. \(\$ 15,000\) of the notes payable are payable next year.

4. Gas and oil expense is a selling expense.

\section*{Instructions}

(a) Enter the trial balance on a work sheet and complete the work sheet.

(b) Prepare a multiple-step income statement and retained earnings statement for the year, and a classified balance sheet at December 31, 1998.

(c) Journalize the adjusting entries.

(d) Journalize the closing entries.

(e) Prepare a post-closing trial balance.

Step by Step Answer:

Financial Accounting

ISBN: 9780471169208

2nd Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso